The "Easy Money" Trap: Lessons from the Cape Coral Flip Crisis

In the world of real estate development, there’s a thin line between a calculated risk and a blind gamble. Recent reports out of Cape Coral, Florida, show us exactly what happens when that line is crossed by "rookie" investors fueled by high-leverage private credit.

The story in Cape Coral is a sobering one for those of us in the industry. What started as a pandemic-era gold rush has turned into a landscape of abandoned job sites, rotting work permits, and "for sale" signs face-down in the weeds.

The Rise of the "Institutional" Hard-Money Loan

Historically, "hard money" was the domain of local lenders who knew every street in their zip code. They were conservative, requiring 40% down and charging double-digit interest. They were a barrier to entry for the inexperienced, which—ironically—protected the market from overheating.

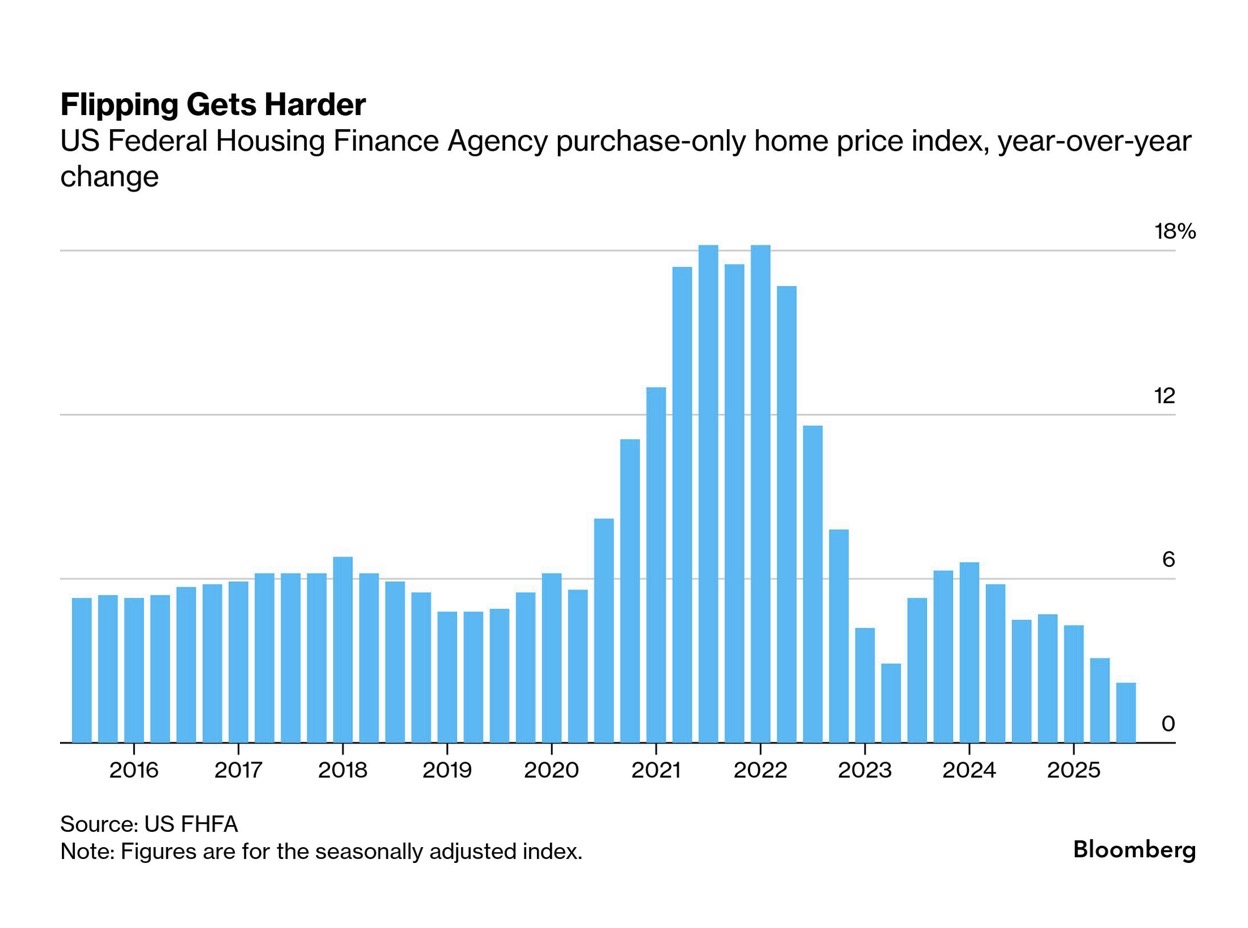

But over the last decade, we’ve seen the rise of standardized private credit. Large investment firms began bundling short-term construction loans into securities. The result?

Lower barriers: Down payments dropped to 10%.

Wider reach: Professionals with no construction experience (doctors, tech workers) were suddenly building ground-up specs from 1,000 miles away.

Standardized risk: Lenders prioritized "origination volume" over local market nuances like soaring insurance costs or hurricane-driven delays.

When the Leverage Inverts

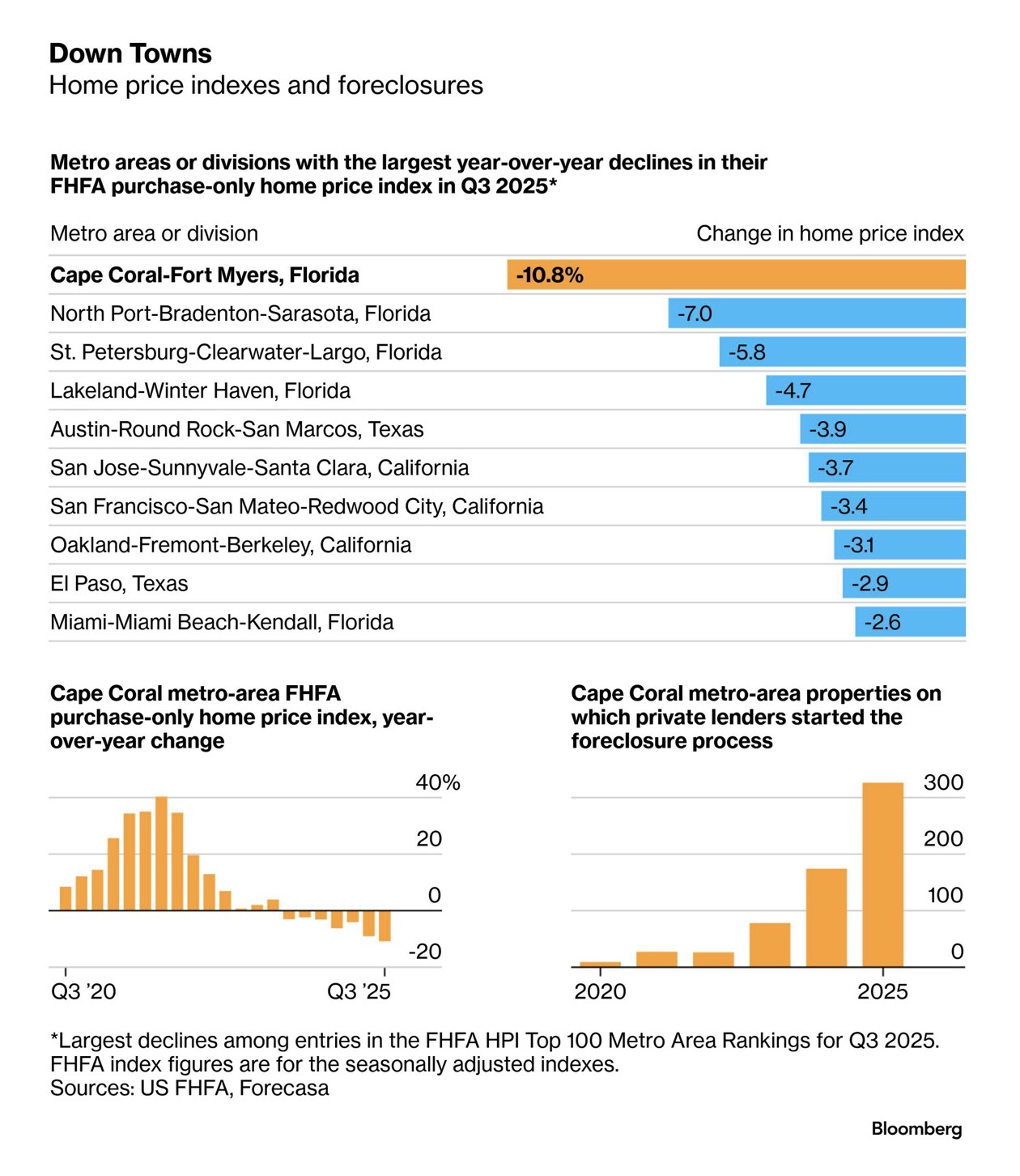

The Cape Coral data is a warning shot for the rest of the country. Private lenders have started foreclosing on 7.4% of properties they financed in 2023—nearly four times the rate of typical mortgages.

As developers, we know that when you’re leveraged at 90%, you have zero margin for error. When interest rates spiked and home prices in the area dipped by 11%, that "equity cushion" evaporated instantly. For many "rookie" flippers, their unfinished homes are now worth little more than the dirt beneath them.

3 Key Takeaways for Professional Developers

Underwrite for the "Turn": As veteran lender Glen Weinberg noted in the Bloomberg report, leverage amplifies gains when times are good, but it exponentially amplifies losses when the market turns. If a deal only works at 90% LTV, it’s probably not a deal you should be in.

The "Turnkey" Opportunity: While the flippers are hurting, savvy builders like Dave Diaz are finding a new niche: The Rescue Mission. Taking over abandoned projects from lenders (the "make-it-go-away" guy) is becoming a viable, albeit risky, business model in distressed markets.

Local Knowledge is Non-Negotiable: Many of the investors losing money in Florida had never even visited the city. They relied on podcasts and "rent-to-retirement" schemes. Real estate remains a physical, local business. If you don’t know the "burrowing owls" or the local insurance climate, you're just a tourist with a checkbook.

The Bottom Line

The "financialization" of the single-family home has made capital easier to get, but it hasn't made development any easier to execute. As the market tests this new era of private credit, the winners won't be the ones who grew the fastest—they’ll be the ones who kept their leverage low and their boots on the ground.

What’s your take on the private credit surge? Are you seeing similar distress in your local market, or is this a Florida-specific bubble? Let’s discuss in the comments.

Comments

Post a Comment