Peak Returns: The Top 10 Mountain Markets for Short-Term Rentals

While the rest of the country is busy watching the winter games on TV, savvy investors are looking at the mountains through a different lens: yield.

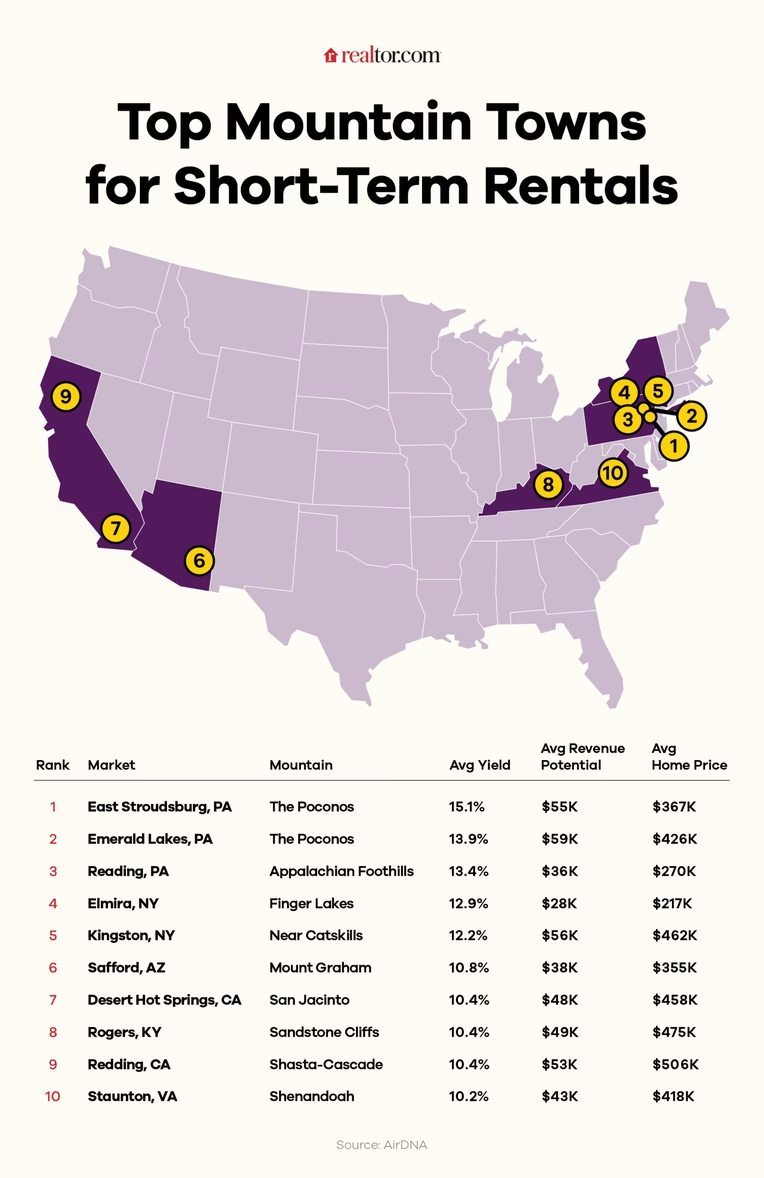

We are currently in the heart of ski season, a time when the "mountain home dream" hits its peak. But as a developer, I’m always looking past the fresh powder to the data. AirDNA recently released a report identifying the top 10 mountain markets for short-term rental (STR) investment.

The takeaway? You don’t need a multi-million dollar chalet in Aspen to see a massive return. In fact, the most resilient markets right now are the "under-the-radar" regional getaways that offer affordable entry points and multi-season appeal.

Why Mountain Markets are Winning

According to AirDNA Chief Economist Jamie Lane, mountain destinations are among the most resilient segments of the STR market. The secret sauce is a combination of steady, multi-season demand and lower acquisition costs compared to famous resort hubs.

These aren't just "fly-in" destinations; they are drive-to spots for major metros. As Hannah Jones from Realtor.com points out, proximity to large cities ensures strong weekend demand year-round.

The Top 10 Investment Peaks

If you’re looking to grow your portfolio, here are the markets currently delivering the strongest "bang for your buck," ranked by average yield.

Key Market Takeaways

The Pennsylvania Powerhouse: The Poconos (East Stroudsburg and Emerald Lakes) are the clear winners. With proximity to NYC and Philly, these markets provide "recess-proof" weekend demand.

The Affordability Play: Elmira, NY, offers a staggering 12.9% yield with a median entry price of just $126,000. For investors looking to enter the market without a massive down payment, the Finger Lakes region is hard to beat.

The Southwest Surprise: Safford, AZ, and Desert Hot Springs, CA, prove that mountain demand isn't just about snow—it's about hiking, scenery, and escaping the desert heat.

The "Design" Edge: In markets like Staunton, VA, seasoned investors are winning by focusing on differentiated amenities and high-end design to stand out in a crowded market.

The Bottom Line

Success in mountain real estate development today isn't about chasing the biggest name; it's about chasing the best margins. We are seeing a shift toward "experiential tourism"—travelers want hiking, wine trails, and privacy, and they want it within a three-hour drive of their home.

Are you looking to add a mountain property to your portfolio this year? I’d love to hear which of these markets surprises you the most. Reach out if you want to discuss how to evaluate the development potential of these emerging "hot spots."

Comments

Post a Comment