Why I’m Scooping Up Discounted Texas Townhomes in 2026 — And Banking Serious Cash Flow Before the Window Slams Shut

I’m excited to share my latest real estate strategy that’s paying off big time: I’m scooping up discounted townhomes across Texas right now—and cashing in on surging rents that are creating a perfect storm for investors like us. If you’re sitting on the sidelines, this window won’t stay open forever. Here’s why I’m going all-in on Texas townhomes and condos in 2025/2026, and why you should consider jumping in before prices rebound.

The Texas Townhome Market Is Offering Serious Discounts

While the national market for attached homes (townhouses and condos) only dipped slightly less than 1% year-over-year, Texas saw a much sharper correction—values dropped more than 4% compared to the previous year, according to real estate analytics from firms like Cotality and trends echoed in Realtor.com data.

This isn’t just a blip. It’s created a rare opportunity where you can buy these properties at prices reminiscent of 2022, but rent them out at today’s higher rates.

Investors Are Piling In—And For Good Reason

Last year, nearly 2 in 5 attached home sales in Texas went to investors, compared to just under 32% for single-family detached homes. That’s an eight-point spread that’s way outside historical norms!

Nationally, investors make up only about 30% of attached-home sales. Texas is leading the pack because smart buyers see the math: lower entry prices (median condo/townhome sale around $300,000 or less in many areas, often $20K+ cheaper than single-family homes) plus easier maintenance and strong rental demand.

And the rental side? That’s where the real money is being made.

Rents Are Climbing While Prices Dip—Creating Cash Flow Gold

While U.S. rents rose modestly by about 1.58% from 2024 to 2025, Texas saw a stronger 2.56% increase. Meanwhile, home prices in the attached segment plunged 4.03%. This gap means investors can buy low, lock in tenants at rising rental rates, and enjoy solid cash flow from day one.

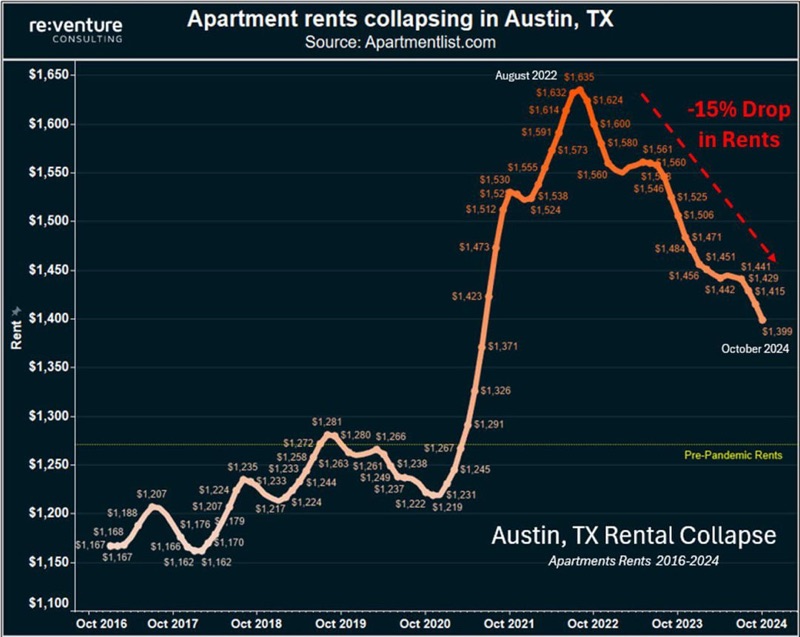

Take a look at these visuals showing the upward trend in Texas rental potential and market dynamics:

Investors are essentially buying assets at yesterday’s prices and leasing them at today’s rates. As one expert put it: this is a “unique window” before appreciation kicks back in.

A Real-World Example: College Station Opportunity

College Station (home to Texas A&M) is a prime spot for this play. Here’s a solid two-bedroom townhouse example that was recently listed around $270,500—down from its previous asking price, making it an attractive buy for rental income near a major university.

These kinds of properties in college towns or growing metros like Dallas, Houston, or Austin suburbs are seeing strong demand from renters, students, and young professionals.

Why This Window Won’t Last—Act Before It’s Gone

The report is clear: investors are signaling that the townhome/condo segment has likely bottomed out. Prices are expected to stabilize and appreciate in the coming years as the market corrects and demand from Texas’s continued population growth pushes rents even higher.

This isn’t forever. Once more buyers (and rising rates or economic shifts) catch on, these discounts will vanish, and you’ll be competing at higher prices for the same cash-flowing assets.

I’m actively acquiring more of these in Texas because the numbers make sense: discounted purchase + rising rents + lower competition in the attached segment = strong returns.

If you’re an investor looking for cash flow, appreciation potential, and a lower barrier to entry than single-family homes, Texas townhomes right now are one of the smartest plays out there. Don’t wait for the crowd—start scouting listings today before this opportunity closes.

What do you think—have you looked at attached properties in Texas lately? Drop a comment below! 🚀

Comments

Post a Comment