Ash to Assets: New Data Reveals the True Financial Toll of the 2025 Palisades & Eaton Fires

One year later, the smoke has long since cleared over Los Angeles, but for the residents of Pacific Palisades and Altadena, the view remains bleak. We are finally getting a look at the "true cost" of the 2025 Palisades and Eaton fires, and the numbers are just as staggering as the charred landscapes left behind.

While the headlines have moved on, the recovery is lagging. For many, "home" is still a hotel room or a temporary rental. Here is the reality of where we stand 12 months post-disaster.

The $8.3 Billion Disappearing Act

According to a recent analysis by Realtor.com®, the financial crater left by these fires is deep. In the celebrity-laden enclave of Pacific Palisades, home values in the fire zones plummeted from $14.7 billion to $10.8 billion. Meanwhile, in working-class Altadena, values dropped from $7 billion to $4.7 billion.

In total, an estimated $8.3 billion in housing wealth was erased across these two communities alone. This doesn't even account for the losses in Malibu or Topanga.

The "Burn Zone" Effect

Perhaps most telling is that you didn't have to lose your roof to lose your shirt. Properties that weren't even physically touched by flames—but were simply located in the hardest-hit zones—saw significant value drops.

Pacific Palisades: $1 billion loss in aggregate value for unaffected homes.

Altadena: $600 million loss in aggregate value for unaffected homes.

If you bought a home between 2020 and 2024 and it was reduced to ash, the "land value" sale price in 2025 was typically 50% lower than what you originally paid. That’s a brutal reflection of the uncertainty and cost now associated with rebuilding in these areas.

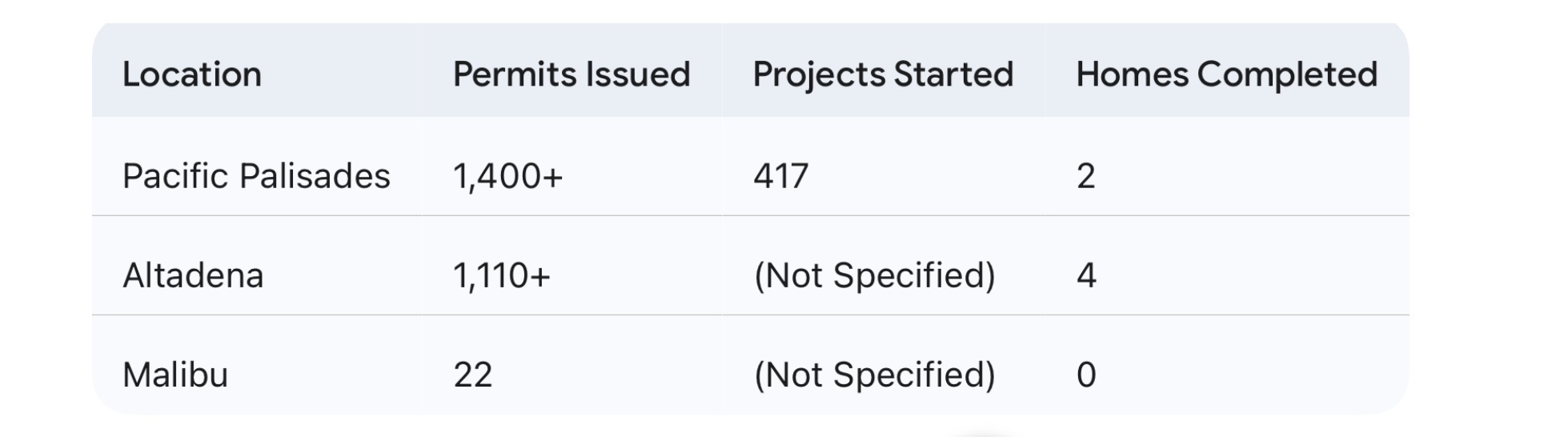

The Rebuilding Bottleneck: By the Numbers

City officials might be using words like "milestone," but the data suggests a different story. The gap between "plans approved" and "keys in hand" is a chasm.

The first home to be completed in the Palisades—a showcase house on Kagawa Street—wasn’t even built for a displaced family. It was a "showcase home" built by a developer to prove recovery is possible. For the families actually living through this, that "milestone" feels more like a PR stunt than a victory.

A Rare Success Story

It isn't all grim statistics. In early December, 67-year-old Ted Koerner became the first Altadena resident to move back into a fully rebuilt primary home.

After a year of bouncing between hotels and subpar rentals, Koerner managed to finish his three-bedroom rebuild in just over four months, beating the winter holidays despite the inevitable permitting headaches. His story is the exception, but it’s the one we hope becomes the rule in 2026.

The Bottom Line

As Realtor.com analyst Hannah Jones put it, we are seeing "immediate losses in housing wealth" paired with a widespread "softening" of the market. The recovery isn't just about clearing debris; it’s about restoring confidence in a landscape that feels increasingly volatile.

Comments

Post a Comment