Florida’s Potential 9% Valuation Spike: A Developer’s Look at the Property Tax Proposal

By Daniel Kaufman

In the world of real estate development and investment, we often look at how operating expenses impact the bottom line. A lower expense ratio usually means a higher net operating income (NOI) and, consequently, a higher asset value.

Florida Governor Ron DeSantis is currently floating a proposal that takes this concept to the extreme: the total elimination of property taxes on owner-occupied homes.

While this sounds like a dream for homeowners, the macroeconomic ripple effects are complex. A new analysis from Realtor.com suggests this move could trigger an immediate 7% to 9% spike in home values.

Here is my breakdown of what this proposal means for the Florida market, looking at it through the lens of valuation and long-term stability.

The Valuation Jolt: Instant Equity

The logic behind the projected price spike is straightforward financial mechanics. Future expenses (like property taxes) are "capitalized" into a home's present value. If you remove a perpetual liability like property taxes, the asset becomes more valuable because it costs less to hold.

The analysis predicts this would boost the aggregate value of Florida's owner-occupied housing stock by $200 billion to $250 billion.

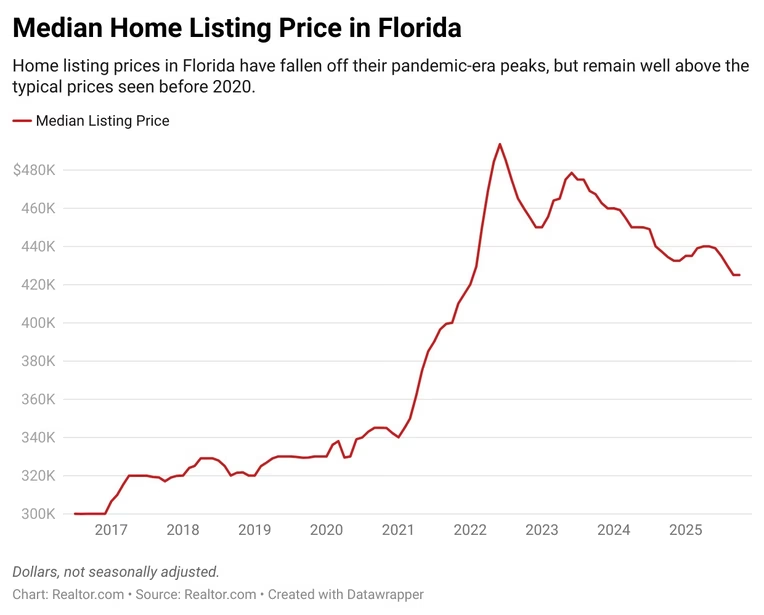

For those of us holding inventory or existing assets in the state, this is an immediate windfall. It acts as a massive correction mechanism for a market that has softened recently (listing prices per square foot were down roughly 3% year-over-year in October).

The "Cost" of Appreciation

While current asset holders win, this policy creates a steeper barrier to entry.

The Affordability Gap: Florida home values are already up 42% compared to 2019, outpacing income growth. A further 9% artificial jolt would make it significantly harder for first-time buyers to enter the market.

The Rental Squeeze: Crucially, this tax cut applies to homesteads (owner-occupied). It does not apply to commercial properties, second homes, or rentals. In fact, to balance the budget, the tax burden may shift heavily toward consumption taxes and commercial real estate. Landlords will likely pass these costs down, leading to higher rents in an already tight market.

The "Black Swan" Risk

The most concerning aspect of this proposal isn't the immediate price movement—it's the structural change to Florida’s revenue model.

Ken Johnson, a housing economist at the University of Mississippi, warns that this creates a "eggs in one basket" scenario. Florida already lacks a state income tax. If you remove property taxes on primary residences, the state becomes reliant on:

Sales tax (tourism and retail).

Taxes on second homes and commercial properties.

The Recession Scenario:

If a national recession hits, tourism dollars dry up. Simultaneously, second-home owners (often the first to sell in a downturn) flood the market with inventory.

Result: A supply glut of vacation homes crashes prices.

Impact: State revenue collapses right when it is needed most.

Johnson calls this a potential "Black Swan" event—where a housing crash and a state budget crisis happen simultaneously because they are tethered to the same volatility.

My Takeaway

As an investor, an immediate 9% appreciation sounds excellent on paper. However, sustainable growth is always preferable to a sugar high.

Eliminating property taxes would undoubtedly reinvigorate a softening Florida market in the short term. But by narrowing the tax base to rely on volatile sectors (tourism and second homes), the state risks amplifying the boom-and-bust cycle.

For developers in Florida, the strategy remains the same: Look for fundamentals, but keep a wary eye on how the state plans to pay its bills if this proposal moves forward.

Key Data Points

Projected Value Spike: 7% – 9% immediately upon enactment.

Aggregate Value Increase: $200B – $250B added to Florida housing stock.

Current Market Context: Florida home values are down ~3% YoY but up 42% since 2019.

The Risk: A "Black Swan" event where a recession collapses both the housing market and state tax revenue simultaneously.

Comments

Post a Comment