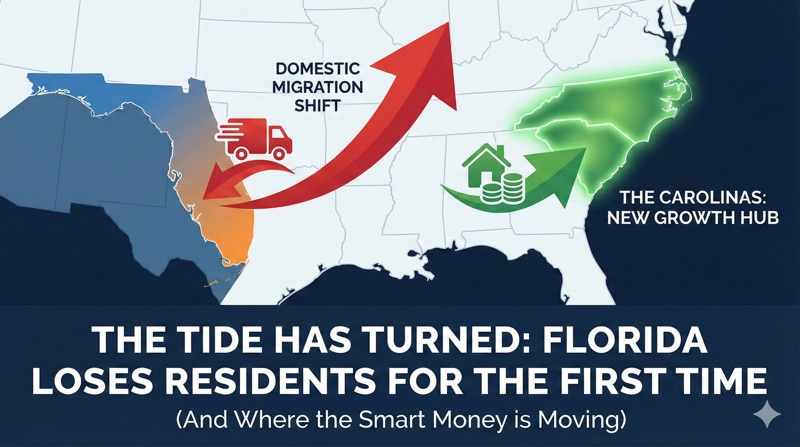

The Tide Has Turned: Florida Loses Residents for the First Time (And Where the Smart Money is Moving)

For decades, the real estate mantra was simple: Follow the sun. Florida and Texas were the unstoppable giants of population growth, fueled by tax incentives, weather, and a pandemic-era remote work boom.

But the data just shifted violently.

According to new U.S. Census Bureau figures, the "Pandemic Boom" has officially petered out. For the first time in recorded census history, Florida had more domestic residents leave the state than arrive.

As an investor or developer, you need to know where that population is shifting to, why the Sunshine State is losing its luster, and how to adjust your portfolio for the coming demographic realignment.

The New Growth Leaders: Look to the Carolinas

While Florida and Texas cool down, the Mid-Atlantic is heating up. The United States has new hotspots for growth, and the data is undeniable:

North Carolina: Claimed the title for total volume, attracting 84,000 new residents from other states—more than any other state in the nation.

South Carolina: Claimed the title for growth rate, expanding by 1.5%.

| State | Status | Key Metric |

| North Carolina | 🟢 Booming | #1 in Net Domestic Migration (+84k) |

| South Carolina | 🟢 Booming | #1 in Growth Rate (1.5%) |

| Texas | 🟡 Slowing | Migration barely edged out SC; growth relied on births |

| Florida | 🔴 Reversing | Negative net domestic migration (First time in history) |

Why the Exodus? The "Push" Factors in Florida

Why did domestic migration to Florida collapse from nearly 319,000 people in 2022 to a net loss in the latest figures? The "bargain" is gone.

According to the University of Florida’s Bureau of Economic and Business Research, the migration reversal is driven by three compounding economic threats:

Exploding Costs: Housing prices have skyrocketed, and Florida is no longer viewed as an affordable alternative to the Northeast.

The Insurance Crisis: Insurance premiums in Florida are significantly higher than in competing markets, killing deal flow and increasing carrying costs for homeowners.

Return-to-Office Mandates: The "work from anywhere" crowd that flocked to Florida beaches is being recalled to office hubs, many of which are not in Florida.

The Human Element:

It isn't just economics. Demographics are shifting due to lifestyle concerns. Families are citing political divisiveness, education quality, and gun violence as reasons for exiting. As one former Tampa resident who relocated to Spain noted, the decision was about "giving future children the best quality of life"—a sentiment that is driving younger demographics away from the state.

The "Pull" Factors: Why North Carolina?

North Carolina isn't just winning by default; they are winning on fundamentals. State demographer Michael Cline credits the surge to a "Goldilocks" scenario that is highly attractive to developers:

The Job Market: High-paying sectors in banking and technology are expanding rapidly.

"Smaller" Big Cities: unlike the sprawling, congested metros of Houston or Miami, NC offers manageable urban density.

Topographical Diversity: The ability to choose between mountains, lakes, and beaches within a single state is attracting younger workers who prioritize outdoor amenities.

The Macro View: The Immigration Factor

There is a ticking clock on these numbers. In the first half of the decade, international migration masked domestic sluggishness in states like Texas and Florida. However, with expected federal crackdowns on immigration, the international pipeline is constricting.

The takeaway: Domestic migration is about to become the only significant driver of population change. If a state cannot attract residents from within the U.S., it will shrink.

Strategic Implications for Real Estate Investment

What does this mean for your capital allocation?

1. Pivot to the Carolinas (The New Sunbelt)

The data suggests North Carolina is the new Texas. Demand for multifamily and single-family rentals in the Raleigh-Durham and Charlotte corridors is supported by high-income job growth (Tech/Banking), not just retirees. Look for opportunities in "secondary" markets in SC that offer spillover value.

2. Re-underwrite Florida Deals

The era of double-digit rent growth in Florida is likely over. Developers must account for:

Slower absorption rates as net migration turns negative.

Higher cap rates to offset the insurance risk.

A potential surplus in luxury inventory if the wealthy "Zoom class" continues to leave.

3. Watch the "Quality of Life" Arbitrage

The new migrant is younger and values "livable" density over sprawling suburbia. Investments in areas with topographical diversity (mountains/lakes) and mid-sized cities are outperforming dense urban cores.

Are you exposed to the Florida slowdown?

Market conditions are changing faster than yearly reports can capture. Would you like me to help you analyze specific demographic data for a county or zip code you are currently invested in?

Comments

Post a Comment