Despite What Brokers and the Media Are Telling You, the Data Doesn’t Lie: Florida Had the Most Foreclosures in the U.S. in 2025

Hey everyone, Daniel Kaufman here.

Welcome back to my real estate development blog, where I’ve been watching the Florida real estate market unravel firsthand.

Brokers and media outlets keep spinning tales of “strong fundamentals” and “healthy corrections,” but let’s cut through the noise. The data paints a grim picture: Florida led the nation in foreclosures in 2025, and with interest rates climbing, things aren’t looking up for 2026.

If you’re a developer eyeing property investments or just curious about the housing scene, buckle up, this is a wake-up call.

The Foreclosure Fiasco: Florida Takes the Crown

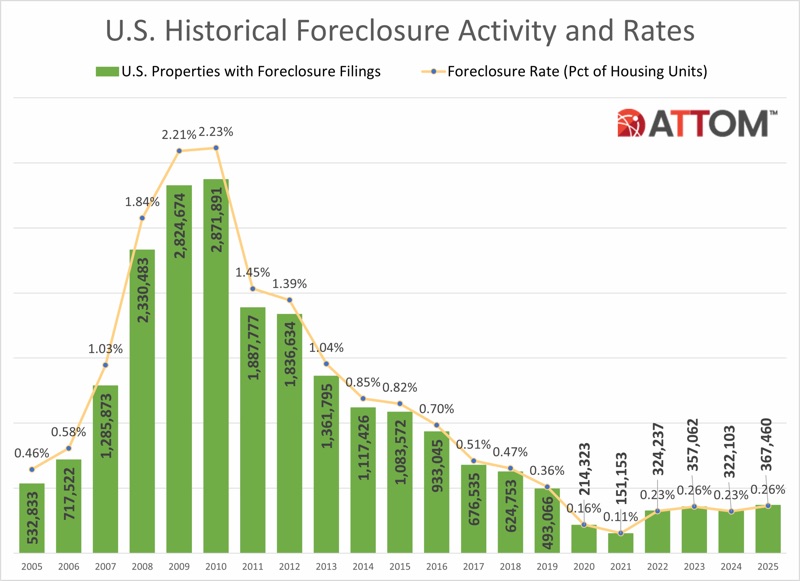

Last year, 2025, saw a staggering 367,460 foreclosure filings across the U.S., a 14% jump from 2024. Sure, that’s still 25% below 2019 levels, but here’s the kicker: Florida had the highest foreclosure rate at 0.44% of residential properties. That’s ahead of states like Delaware (0.42%), South Carolina (0.41%), and Illinois (0.40%). Why? Experts point to skyrocketing insurance premiums, property taxes, and overall ownership costs squeezing homeowners dry. Add in softening demand and slower price growth, and you’ve got a recipe for distress, especially for those who bought at peak prices.

Nationwide, foreclosure activity spiked 57% in December 2025 alone, with 44,990 properties hit. In Florida, metros like Cape Coral ranked among the worst. But don’t take my word for it, check out this historical chart showing the uptick in U.S. foreclosure activity.

Rob Barber, CEO of ATTOM, calls it a “market recalibration,” but that sugarcoats the pain for families losing homes. Homeowner equity is still high at 71.6%, which limits widespread underwater mortgages, but with rates rising, even a 10% value drop could push more folks to the brink.

Price Declines Spreading Like Wildfire

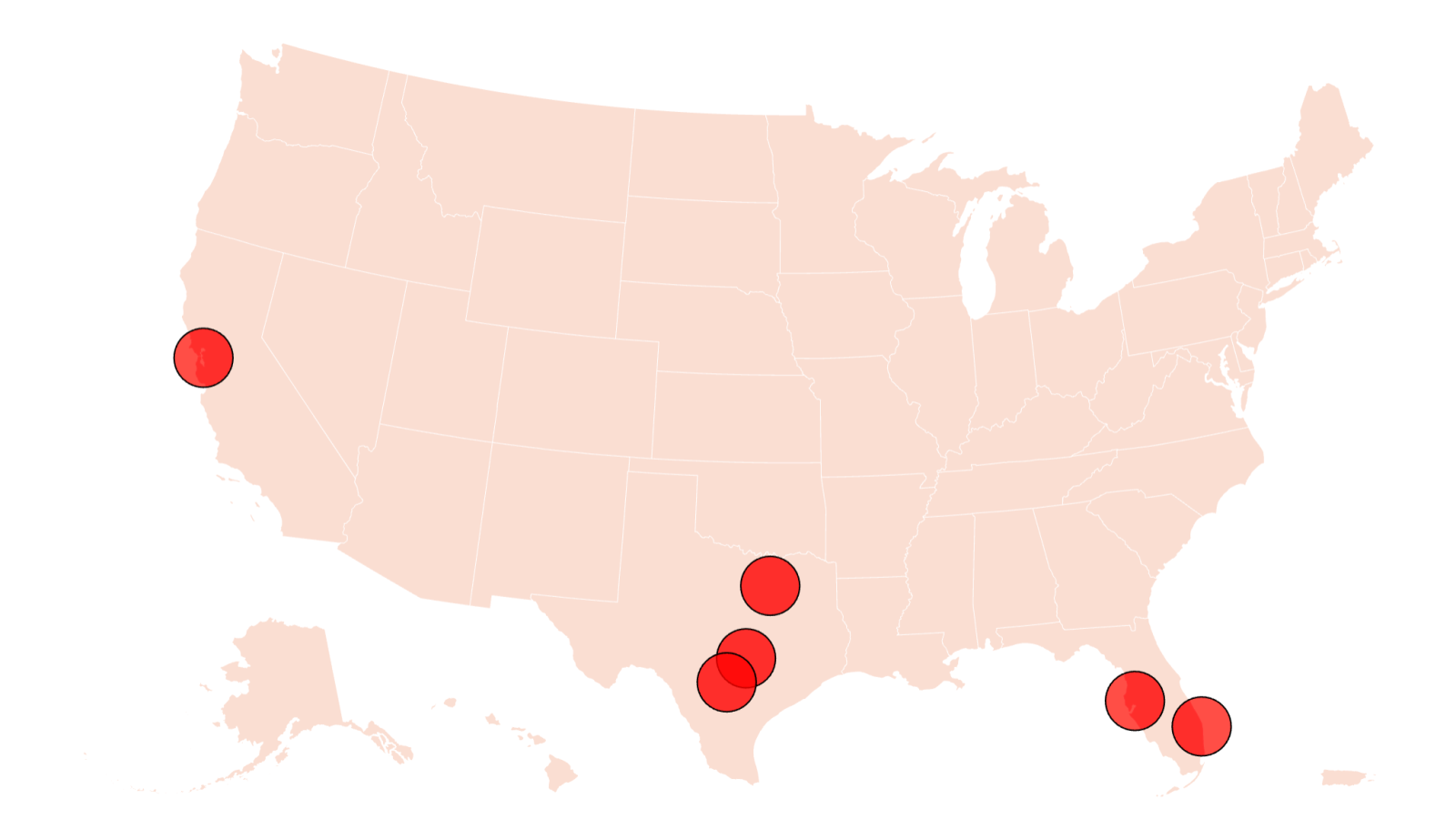

It’s not just foreclosures; home prices are tanking in key Florida markets. Annual U.S. price growth slowed to a measly 1.1% in October 2025, the weakest in over a decade. But zoom into Florida, and it’s brutal: nine of the ten weakest markets for price growth are in Florida and Texas, with five big declines right here in the state. Metros like Punta Gorda, Cape Coral, Sebastian, North Port, and St. Petersburg saw drops between 5.5% and 8.9%.

Cotality’s data flags five Florida cities at high risk for significant price dips in 2026: Cape Coral, Fort Lauderdale, Lakeland, Palm Bay, and West Palm Beach. These aren’t isolated blips—seven of the top 10 “coolest” (read: declining) U.S. housing markets are in Florida, with Cape Coral down 7.1% year-over-year, Naples at -6.7%, and Punta Gorda at -6.2%.

Take Cape Coral as a case study: median home prices fell nearly 7% in August 2025 from the year before, and over 13% from August 2022’s pandemic peak. North Port? A whopping 20% drop over three years. Factors like higher interest rates, insurance woes (Cape Coral’s premiums hit 2.2% of home value—$7,700 yearly for a $350K house), and foreclosures are killing buyer enthusiasm. Here’s a map highlighting cities where prices are falling fastest.

Zillow data shows Florida prices down 5.4% year-over-year overall. Inventory is shrinking, but not from hot sales—it’s delistings. In August, Miami saw 59 delistings for every 100 new listings, Tampa 33, and Orlando 28. Sellers are pulling out rather than accept lower offers, leaving the market in a “mixed bag” of low demand and stalled activity.

The Bubble Talk: Miami Tops the Risk List, But Is It a Crash?

Media loves to hype Miami’s “vibrant” market, with low unemployment (3.7% in August 2025) and influxes from high-income migrants. Gay Cororaton from the Miami Association of Realtors insists price growth is fundamentals-driven, not speculation. But UBS Global Wealth Management ranked Miami as the world’s riskiest housing market for the second year running in 2025. Median single-family home prices jumped 70% since 2019—faster than the national 50%—but growth has stalled amid affordability crunches from rates and insurance.

Jonathan Woloshin from UBS warns risks are high, though not a guaranteed collapse. Still, with median incomes at $76K supporting only $300K mortgages (way below actual medians), the math doesn’t add up. And Governor DeSantis’s push to cut property taxes? That could ironically inflate prices further, but in a cooling market, it’s a wildcard.

Experts like Hannah Jones from Realtor.com call it a “rebalancing,” but for buyers and sellers, it’s chaos. This image captures the ongoing debate about a potential Florida housing crash in 2026.

Brokers vs. Data: Who’s Telling the Truth?

Brokers like Cara Ameer and Karen Borrelli downplay it as a “correction,” not a crisis. They say sales volumes are steady, buyers are active but picky, and it’s a great time to buy if priced right. Media echoes this: no Great Recession repeat, equity buffers in place, job growth solid.

But the data doesn’t lie. Foreclosures leading the nation, widespread price drops, high-risk metros, and delistings signal a market in reverse. After the pandemic boom (51% price surge from 2020-2022), this “snap back” feels more like a slump. Florida’s appeal—low taxes, beaches—can’t offset hurricane risks and cost hikes forever.

What This Means for Developers and Investors in 2026

As a developer myself, I’m cautious. If you’re building or flipping in Florida, factor in longer market times and motivated sellers. Buyers: Hunt for deals in cooling spots, but budget for insurance shocks. Sellers: Price realistically or risk sitting idle. Investors: Long-term plays in undervalued areas could pay off, but short-term? Risky.

The market isn’t crashing like 2008, but it’s bad enough to ignore the hype. Stay data-driven, folks. What are your thoughts on Florida real estate? Drop a comment below—I’d love to hear from fellow developers navigating this.

Thanks for reading. Until next time, keep building (wisely).

— Daniel Kaufman, Real Estate Developer

Comments

Post a Comment