The Markets That Made Millionaires: My Take on America’s Biggest Home Value Winners

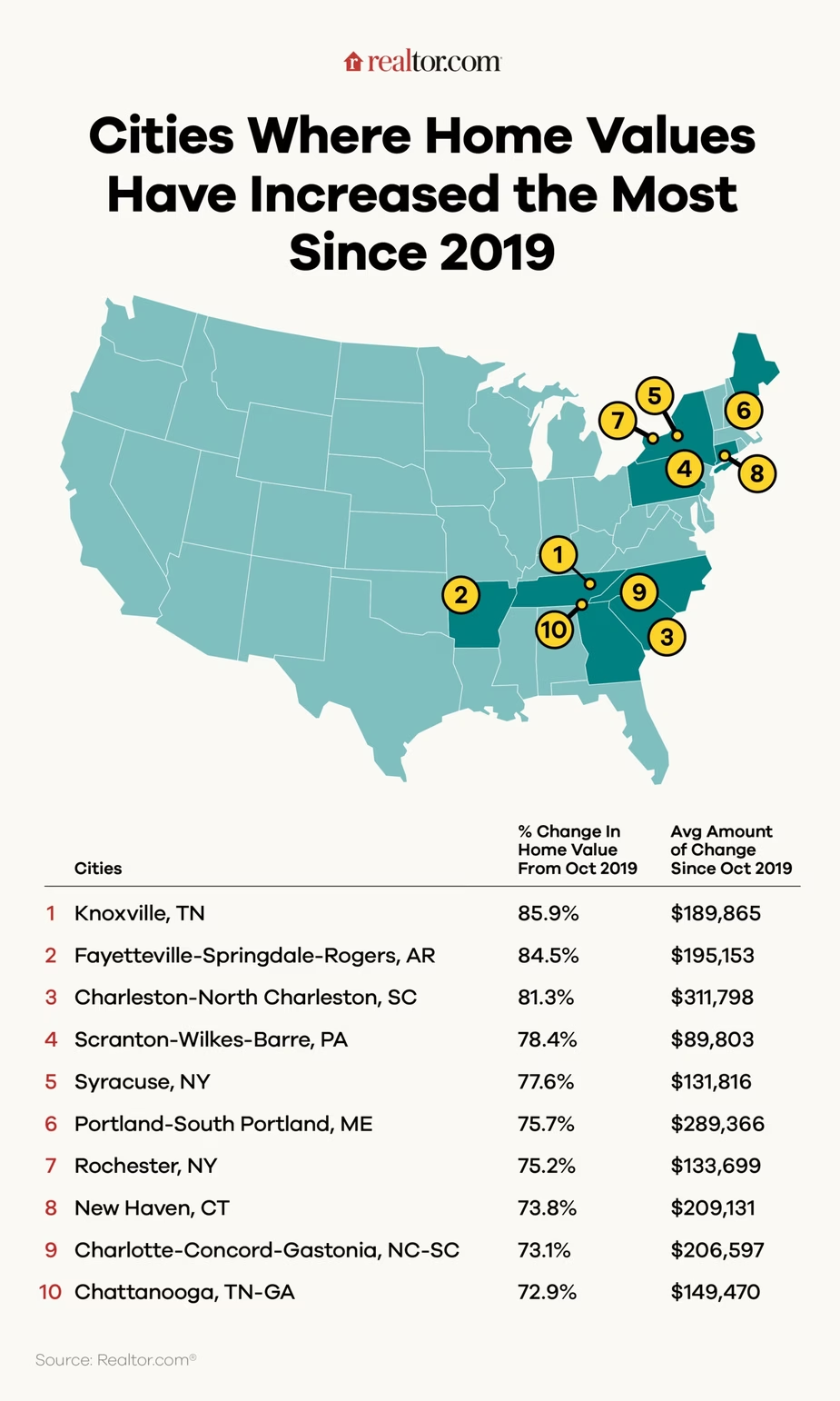

As someone who’s spent decades analyzing real estate markets and deploying capital across the country, I pay close attention to where home values are moving—and why. The latest data from [Realtor.com](http://Realtor.com) reveals something I’ve been watching closely: ten cities have experienced extraordinary appreciation since 2019, with gains that have fundamentally reshaped local wealth dynamics.

The Fundamentals Still Matter

Let me start with what hasn’t changed: supply and demand drive everything in our business. When sales volume surges without corresponding construction activity to match it, values climb. It’s Economics 101, but the magnitude of recent gains in certain markets has been remarkable—even by historical standards.

Ten cities stand out for exceptional appreciation across the top 100 U.S. metros. Interestingly, they split evenly between the South and Northeast, though for very different underlying reasons. This geographic distribution tells me we’re not looking at a single trend but multiple regional dynamics at play.

Knoxville: The Standout Story

Knoxville, Tennessee takes the top spot—and the numbers are staggering. The average home there appreciated nearly 86% between October 2019 and October 2025. We’re talking roughly $190,000 in value creation per property. From an investment perspective, that’s the kind of return that transforms portfolios.

What makes Knoxville’s story particularly interesting is that this wasn’t overnight success. According to local agent Regina Santore at Wallace Real Estate, the city made a deliberate pivot around 2001, focusing on becoming “a great place to live, work, and play.” By 2019, that strategy was paying dividends with national recognition.

The fundamentals supporting Knoxville’s appreciation are textbook:

Employment: Companies offering quality jobs with innovation-focused culture keep moving in. This isn’t just population growth—it’s quality population growth with household formation capacity.

Fiscal advantages: Tennessee’s zero state income tax creates a meaningful competitive advantage, particularly for higher earners relocating from tax-heavy states.

Quality of life infrastructure: A walkable downtown, extensive trail systems just two miles from the city center, and the amenities you’d expect in a university town (University of Tennessee is based there) create genuine livability that justifies premium pricing.

Cost basis advantage: Despite the appreciation, Knoxville still maintains lower cost of living than many competing markets.

From a development standpoint, this is exactly the kind of market I look for—one where long-term fundamentals justify current valuations rather than speculation driving prices.

The Pandemic Acceleration

Like many markets, Knoxville’s already strong trajectory went parabolic during COVID. Home value appreciation jumped from a healthy 8% annually to 28% at the peak. Properties were seeing a dozen-plus offers. Sellers who’d owned for just a year were realizing $100,000 in equity gains.

I’ve seen this movie before in other markets. That kind of rapid appreciation creates both opportunity and risk. The opportunity is obvious—exceptional returns for those positioned correctly. But the risk is equally clear: you can price out the next generation of buyers and create affordability crises that ultimately constrain future growth.

The Post-Pandemic Reality

Here’s where it gets interesting from an investment perspective. As rates normalized, Knoxville’s appreciation cooled back to around 3% annually. That’s actually healthy—it’s sustainable growth rather than bubble dynamics.

But the damage to affordability has been done. Millennials and Gen Z buyers are largely priced out of starter homes, partly because new construction hasn’t kept pace. This is the supply-side constraint I mentioned earlier playing out in real-time.

For developers like me, this presents opportunity. Markets with proven demand, constrained supply, and priced-out first-time buyers are exactly where new construction pencils—if you can navigate the entitlement process and construction costs effectively.

The Broader Implications

What Knoxville and the other nine cities on this list demonstrate is that even in an era of higher rates and affordability challenges, well-positioned markets with strong fundamentals can deliver exceptional appreciation. The key is understanding *why* values are rising—whether it’s sustainable job growth, lifestyle advantages, fiscal benefits, or supply constraints.

From my perspective as both a developer and investor, these markets warrant serious analysis. The appreciation we’ve seen since 2019 has created wealth for existing homeowners, but it’s also created development opportunities in markets where demand clearly exceeds supply.

The cities that experienced 50%, 70%, or even 85%+ appreciation didn’t get there by accident. They offered something—jobs, lifestyle, value, or all three—that attracted sustained demand while supply remained constrained. That’s a formula that works in real estate, whether we’re talking about single-family homes or the mixed-use developments I typically focus on.

The question now is which markets are positioned for the next wave of appreciation—and where capital can be deployed most effectively to capture that growth while addressing the housing supply challenges these successful markets have created.

What are your thoughts on these high-appreciation markets? Are you seeing similar dynamics in your area?

Comments

Post a Comment