Rising Ambitions, Skyrocketing Costs: What Project Stargate Really Means

When you build in gigawatts instead of megawatts, the questions aren’t just about engineering—they’re about money, politics, and timing.

That’s what makes Project Stargate the most fascinating (and concerning) infrastructure initiative I’ve seen in years.

Scale: From Big to Ludicrous

Since its White House debut earlier this year, Stargate has ballooned in scope. What started as 1.2 GW of planned capacity at a $12 billion Texas site has quickly multiplied: 4.5 GW here, 7 GW there, announcements in the U.S., UK, UAE, and even Norway. The ambition isn’t incremental—it’s exponential.

In July, Oracle and OpenAI confirmed 4.5 GW of new capacity (on top of the original site), backed by two million Nvidia GPUs. Then in September, Oracle’s stock jumped 30% after revealing a cloud backlog north of $500 billion—later tied in part to a jaw-dropping $300 billion OpenAI commitment.

To put it in real estate developer terms: this is like announcing you’ll build Manhattan, then immediately promising to replicate it ten times over. The scale isn’t just aggressive—it’s bordering on “Project Ludicrous,” which, fittingly, was the code name.

Financing: The Billion-Dollar Circular Question

Here’s where my investor brain starts twitching.

OpenAI is reportedly burning $8.5 billion annually against $13 billion in revenue. Ambitious growth is one thing; agreeing to $300 billion in cloud spend over five years is another. The Nvidia deal adds another layer: a $100 billion “investment” in OpenAI, to be recycled into buying Nvidia chips. Industry insiders are right to question if this structure is less “capitalization” and more “financial Möbius strip.”

I’ve raised and deployed capital for large-scale projects—$100 million here, $500 million there. I can tell you firsthand that structuring a $100 billion flow where the money goes out and comes right back in raises eyebrows. It might work in the short term, but it smells like bubble dynamics in the making.

Power: The Real Constraint

Forget money for a second. Let’s talk physics.

Data centers at the scale Altman envisions—250 GW by 2033, at a cost of $12.5 trillion—would consume more power than entire countries. Developers know that securing 20 MW for a regional cloud facility is already a battle with utilities. Now multiply that by 10,000.

Even if you line up the capital, the permitting, and the GPUs, you still face the bottleneck of electrons. Where will 250 GW come from? What mix of nuclear, renewables, gas, or yet-to-be-commercialized tech gets us there? Without serious grid modernization, this doesn’t pencil out.

Why It Matters for Developers and Investors

As a real estate developer and technologist, I’ve seen how bold visions can transform skylines and industries. But ambition without a financing and infrastructure strategy is just a rendering.

Project Stargate is an audacious bet on AGI, underpinned by a financing structure that looks speculative, and a power plan that’s still a question mark. If it succeeds, it could redefine global infrastructure investment the way railroads and interstate highways once did. If it fails, it could mark the peak of the AI hype cycle.

Either way, anyone who builds, finances, or invests in large-scale infrastructure should be paying attention. Because whether you’re pouring concrete in Texas or designing chips in Taiwan, Stargate is going to reshape the opportunity—and risk—landscape for the next decade.

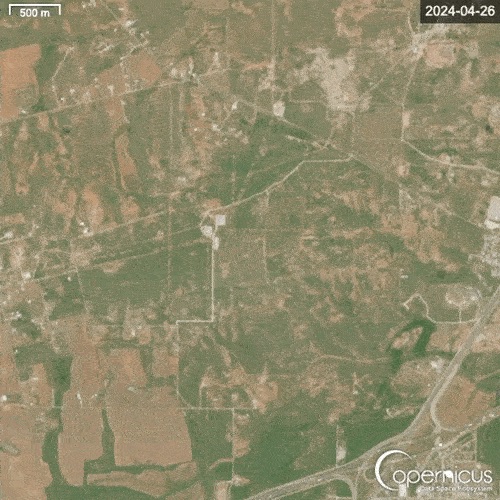

A time lapse of Stargate I construction, in Abilene, Texas. Imagery from April 26, 2024, to September 29, 2025 (Copernicus)

Comments

Post a Comment