Minimum-Wage Workers Are Clocking 80+ Hours a Week Just to Afford Rent

As a developer, I look at numbers every day—construction costs, financing terms, rent rolls. But sometimes a single stat cuts through the noise and makes you pause: in some U.S. cities, minimum-wage workers need to clock over 80 hours a week just to pay rent on a modest apartment.

Let’s break that down. That’s not 80 hours a week to build wealth, save for retirement, or send a kid to college. That’s 80 hours a week simply to put a roof over your head. It’s a stark reminder of how disconnected wage growth is from rental pricing, and why affordability is one of the defining challenges for our industry.

The Numbers Don’t Lie

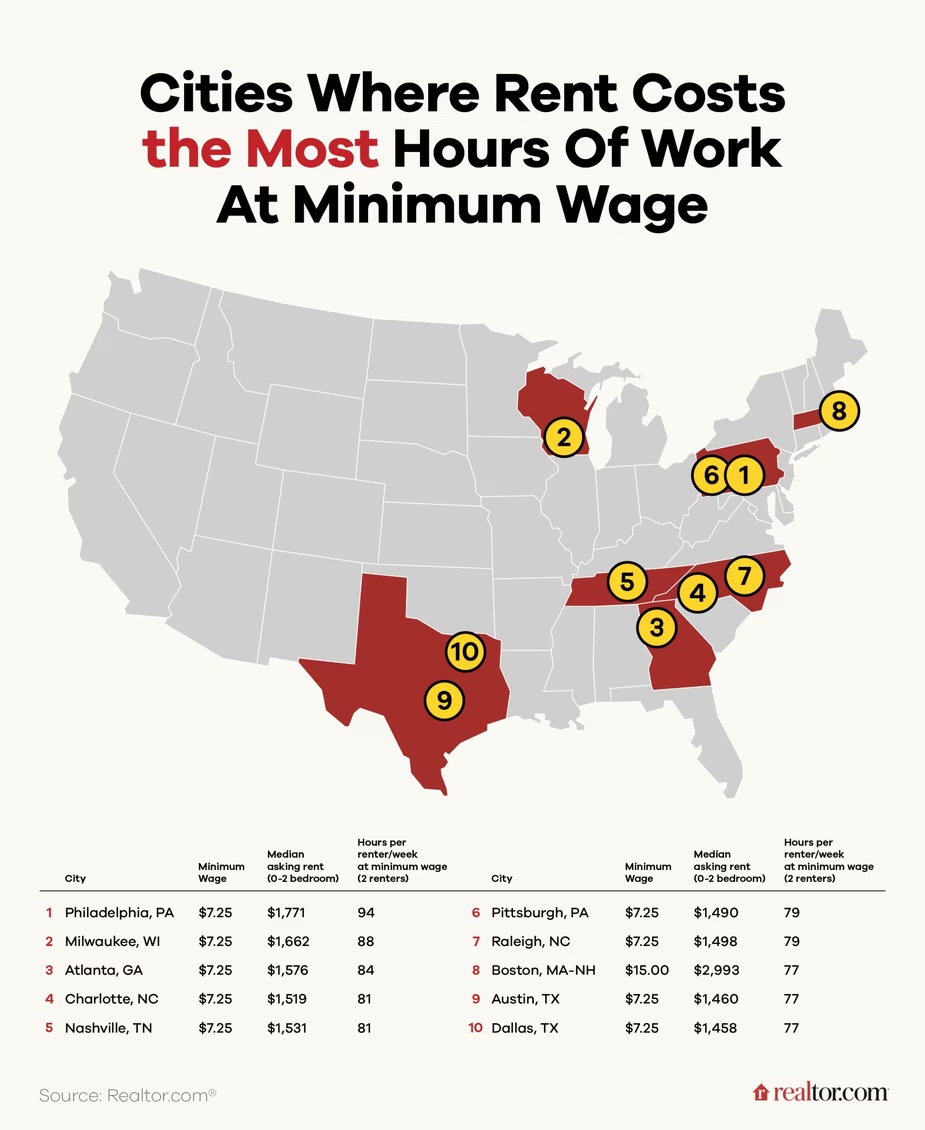

Realtor.com’s data lays out the imbalance clearly:

- Even after two years of rent softening, workers earning minimum wage are barely keeping pace.

- Many of the hardest-hit cities aren’t just coastal “usual suspects” like Boston or New York. Places like Milwaukee and Atlanta top the list because wages there simply haven’t kept up with housing costs.

- Across these top 10 hardest cities, minimum-wage workers are earning an average of just $8.03 an hour, while median rents hover around $1,696 per month.

Take Philadelphia as an example:

A $7.25 hourly wage vs. $1,771 monthly rent means a worker splitting a unit with a roommate must work 94 hours a week to stay under the 30% affordability threshold.

These aren’t numbers you can spin. This is the brutal math of housing in America.

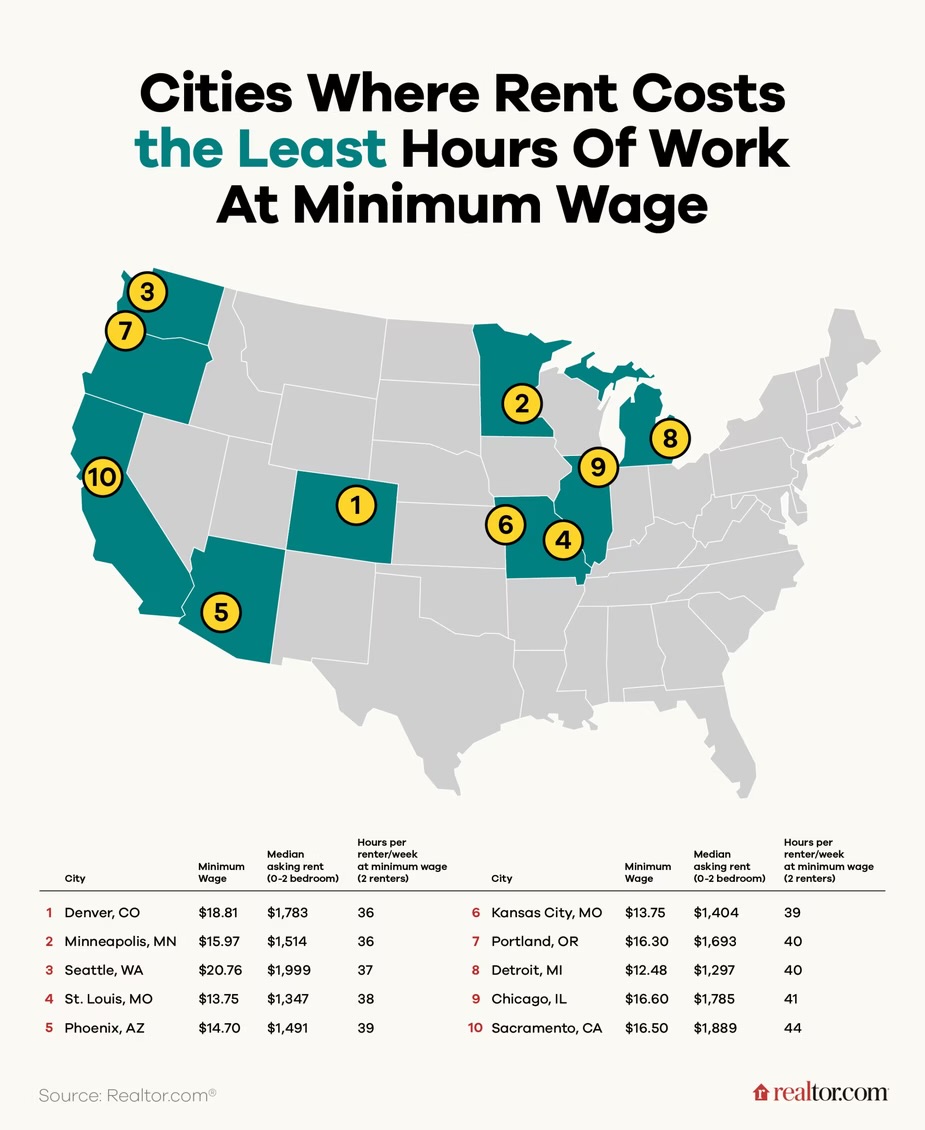

Where Higher Wages Make a Difference

The flip side is equally revealing. In markets like Seattle, Minneapolis, and Denver, higher minimum wages make a huge difference—even when rents are high. Seattle’s median rent is nearly $2,000, yet a $20.76 minimum wage means a worker only needs to put in 37 hours a week to cover rent.

Across the ten most “affordable” major cities (relatively speaking), wages average $15.82 an hour, double the pay in the hardest-hit markets. The rent is slightly lower too, around $1,554 a month, but wage policy is the real driver of affordability here.

Why This Matters for Developers and Investors

If you’re building or investing in housing, this data is more than a sobering headline—it’s a market signal.

- Affordability pressure is reshaping demand: renters are doubling up, delaying moves, and driving growth in BTR (build-to-rent) communities and modular housing solutions.

- Policy trends matter: wage increases in certain markets are already affecting absorption rates and tenant stability.

- Opportunity zones aren’t just tax terms: cities like Detroit and Kansas City, where wage and rent dynamics are healthier, may offer better long-term fundamentals than high-rent, low-wage metros that look good on paper but hide structural risk.

At Kaufman Development, we’re building for a future where affordability will define success. We’ve seen firsthand how modular construction, smart design, and thoughtful financing can shift the equation—and this data is more proof that the old playbook isn’t enough.

Final Takeaway

Housing affordability is a national crisis, but it’s also a roadmap. These numbers aren’t just a warning—they’re a call to rethink how we develop, finance, and price housing. If we want healthy, stable communities, we need projects that align with real-world wages, not just investor pro formas.

For now, the math speaks for itself: millions of Americans are paying for housing with a second full-time job.

Comments

Post a Comment