Data Center Demand is Reshaping North American Real Estate

The North American data center market has officially hit a new inflection point. Vacancy dropped to just 1.6% in the first half of 2025, a record low, as AI adoption and hyperscale growth fuel unprecedented preleasing activity. For developers, investors, and operators, this isn’t just a strong market—it’s a structural shift in how digital infrastructure is built, financed, and delivered.

Demand Is Outpacing Supply—By Design

CBRE’s H1 2025 Data Center Trends report highlights what we see firsthand: tenants are no longer waiting for supply to hit the market. Hyperscale and AI-driven occupiers are preleasing space years in advance to guarantee access to power and capacity, which are now the two defining constraints in site selection. Nearly three-quarters of all capacity under construction is already spoken for.

As developers, this means our timelines, capital structures, and land strategies must account for a world where absorption is front-loaded. Power is no longer just a utility—it’s the gating factor that determines whether a site becomes viable or sits on the sidelines.

Large Requirements Are Driving Pricing Power

The biggest deals—10 MW and larger—are setting the tone for the entire sector. Limited near-term power access, elevated construction costs, and surging demand from hyperscalers are pushing pricing north of $200/kW/month for continuous deployments. These tenants are less price-sensitive than they are power-constrained, which allows landlords and operators to command premiums for long-term, high-capacity leases.

Markets like Northern Virginia continue to dominate, with 538.6 MW of net absorption and an 80% jump in under-construction capacity. But we’re also watching other metros:

- Atlanta added nearly 1 GW of new inventory in H1, the fastest growth in North America.

- Dallas-Fort Worth is positioned to double by 2026, as development pipelines convert into completions.

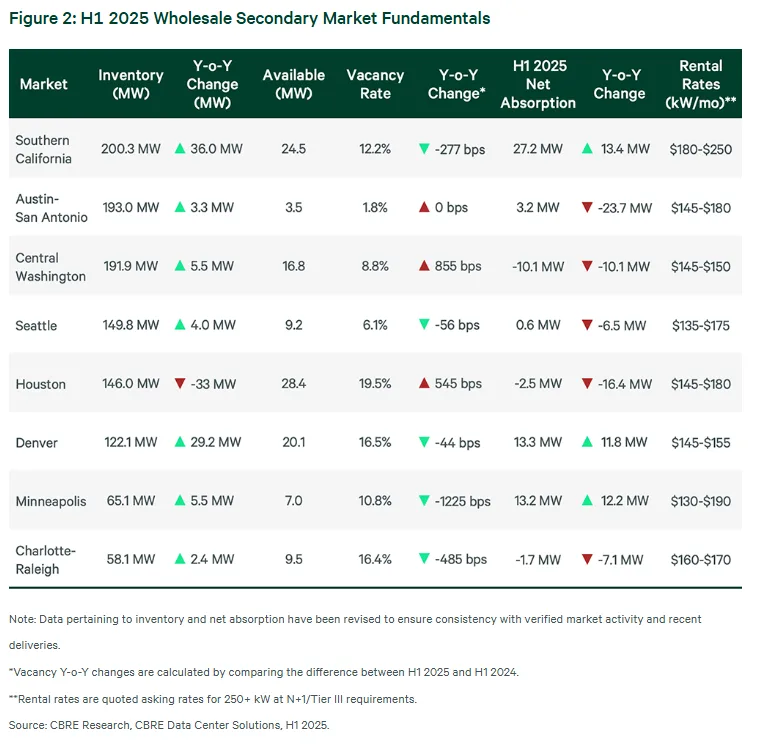

- Secondary markets like Charlotte-Raleigh, Austin, and San Antonio are drawing attention as occupiers chase available power and shorter timelines.

Why It Matters for Developers and Investors

For traditional real estate developers, data centers used to be a niche asset class. That’s no longer the case. With AI training, cloud adoption, and digital transformation accelerating, data centers are now one of the most critical pillars of the built environment.

At Kaufman Development, we view this shift through two lenses:

- Development: Aligning land acquisition with power availability, zoning, and grid resilience.

- Investment: Structuring capital stacks that match long-term leases with institutional-grade financing, while remaining agile enough to seize opportunities in emerging markets.

The opportunity isn’t just to build boxes with servers. It’s to deliver infrastructure that underpins the next era of the economy—one that requires scale, speed, and certainty.

Looking Ahead

Lease rates may stabilize from the double-digit jumps we’ve seen, but availability will remain tight well into 2026. Developers who can secure power and deliver capacity faster will control the most valuable commodity in real estate today: digital infrastructure.

The race for data centers is more than a tech story—it’s a real estate story. And like every cycle before it, those who innovate early will shape the market for years to come.

Comments

Post a Comment