Cracks in the Labor Market Are Harder to Ignore — Market Is Pricing in a Fall Rate Cut

Sunday, August 3, 2025

By Daniel Kaufman

As we close out the weekend, it’s worth reflecting on how dramatically last week shifted the economic landscape—and what it means for capital, lending, and real estate fundamentals going forward.

Labor Market Turns Spotlight on Weakness

Last Wednesday, the Federal Open Market Committee elected to maintain its benchmark rate at 4.25%–4.50%. As expected. But two Fed Governors—Waller and Bowman—voted for a cut, marking the first dual dissent since 1993.

Despite that, Chair Powell sounded hawkish in his post‑meeting remarks, reaffirming that labor market conditions remained “broadly in balance.” That set the stage… until Friday’s jobs report hit.

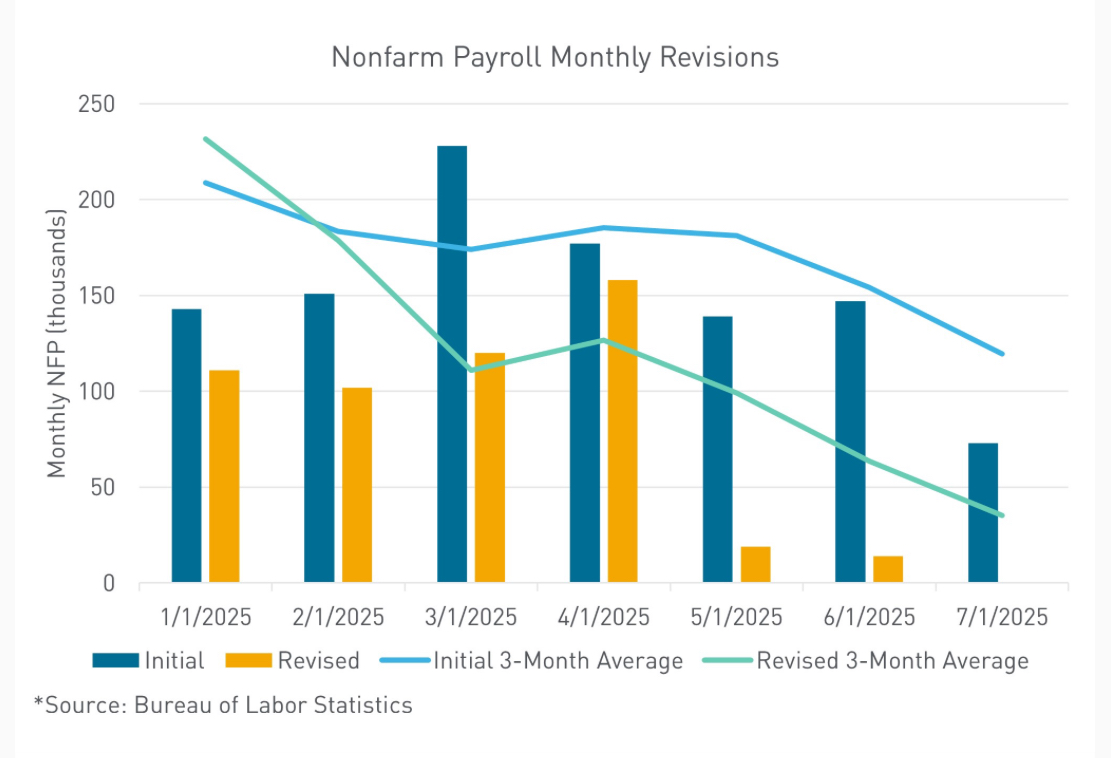

On Friday, Nonfarm Payrolls revealed just 73,000 jobs added in July—well below consensus expectations. Even more concerning, revisions cut May and June payroll gains by a staggering 258,000 jobs. The three-month average cratered from approximately 150,000 down to just 35,000 per month.

For real estate professionals, that matters deeply: job creation drives demand for office space, retail leasing velocity, multifamily occupancy, and construction activity. Slow labor growth now means slower rent growth ahead—and more caution around underwriting.

Markets Whipsawed on Rate-Cut Odds

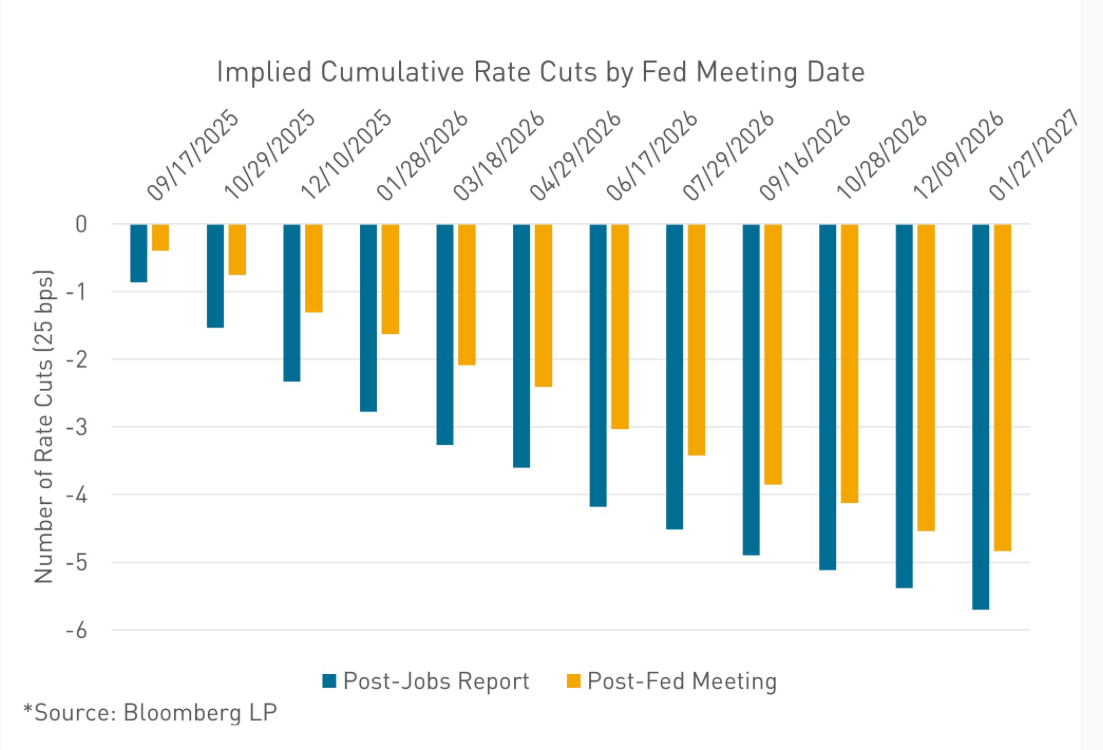

Earlier in the week, futures had been pricing around a 68% chance of a September rate cut. Following Powell’s cautious tone, that dropped to 39%. Then Friday’s payroll miss swung sentiment back sharply upward—markets now see nearly a 90% probability for a September cut.

If the labor market is softening faster than assumed, the Fed’s flexibility increases—even amid sticky inflation driven by tariffs. That recalibration has major implications: borrowing costs may come down, but volatility will remain high.

GDP Growth—Surface Strength, Real Weakness

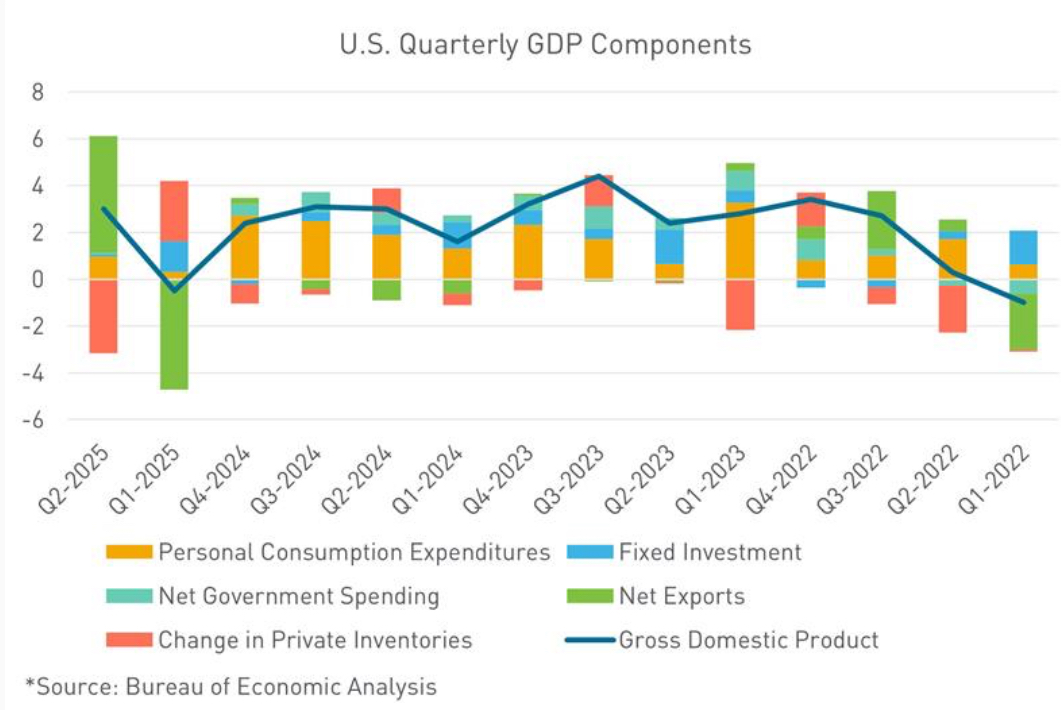

The Q2 GDP print of 3.0% looked solid… until you dig in. Most of that growth stemmed from front-loaded net exports—firms rushing to ship before new tariffs hit. That’s lumpy, not sustainable, and masks anemic domestic demand.

Final sales to domestic purchasers rose only 1.1%; consumer spending edged up just 1.4%, with housing and services particularly sluggish. These are real data points that real estate people track—not just headlines.

Big Picture: A Fragile Foundation

What we saw last week is a classic example of headline strength masking structural fragility. The labor market weakness, paired with soft consumption and housing demand, should be setting off alarms for those underwriting deals today.

If unemployment creeps meaningfully above the current 4.2%, the odds increase that the Fed will act—even if core inflation remains above target. Preserving labor market stability could become the top priority over fighting inflation.

What It Means for Real Estate Investors

- Due diligence needs work: Same underwriting that looked conservative in Q1 may be too aggressive if occupancy or rent ramps slow.

- Refinancing risk is rising: Falling interest rates could help—but not without volatility and timing risk.

- Opportunity in repositioning: Weakness creates windows for deals, especially in distressed or secondary assets. But cash flow stress also rises.

Bottom Line

We spent the week thinking the labor market was resilient. Then adjustments and softer readings laid bare its cracks. GDP numbers looked good—until you look under the hood. And now, financial markets are pricing in rate cuts ahead of schedule.

For investors and developers, this is a moment to stay nimble: adjust models, sharpen underwriting, and lean into the volatility—but only if you’re watching the real signals.

Comments

Post a Comment