Multifamily Permitting Trends: The New Convergence of Key U.S. Markets

The multifamily market is seeing some intriguing shifts as we dive into the latest U.S. Census data. While permitting momentum varies across major cities, four key markets have found common ground in their multifamily permit volumes, indicating some intriguing future trends for developers and investors. Here’s a closer look at the numbers and what they mean for the landscape of multifamily real estate development in 2025.

A Convergence of Four Key Markets

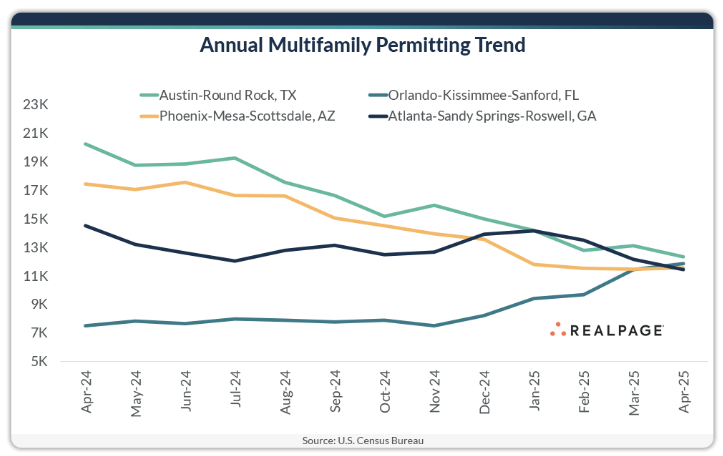

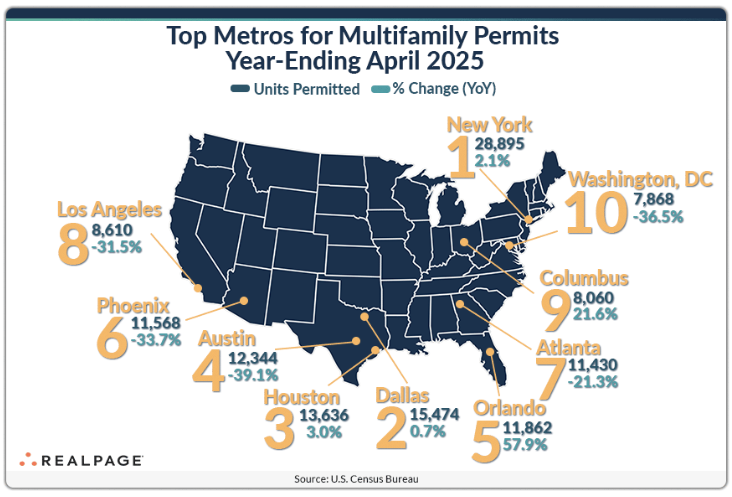

In the year ending April 2025, multifamily permitting levels across Austin, Orlando, Phoenix, and Atlanta aligned in a tight range between 11,400 and 12,300 units. This convergence is notable for its consistency across diverse regions, but the trends within these markets tell a deeper story:

- Austin: The Texan tech hub saw the steepest drop, shedding nearly 8,000 units YoY. Despite its reputation as a booming tech and real estate hotspot, this decline signals a cooling off, potentially influenced by shifting tech industry dynamics or higher costs of development.

- Orlando: On the other hand, Orlando surged ahead, with a notable 4,351-unit increase, making it one of the few markets seeing consistent gains. With an influx of residents seeking affordable housing and the city’s continuous growth in tourism, this area remains a strong contender for future investment.

- Phoenix and Atlanta: Both of these markets also saw declines—Phoenix dropped by nearly 6,000 units and Atlanta by over 3,000. While these numbers show some retrenchment, the sheer size and resilience of these cities suggest that the slowdown may be temporary, with potential for rebounds as developers adjust to new economic conditions.

Rising and Falling Markets

While certain metros like New York, Dallas, and Houston saw modest gains, others like Los Angeles and Washington, DC recorded significant drops of 4,000–4,500 units. This trend reflects the broader challenges facing coastal markets, which are increasingly struggling with higher construction costs and shifting economic pressures.

In South Florida, Miami experienced a noticeable decline of over 3,000 units, slipping to #16 nationally in permitting. Likewise, Tampa mirrored this loss, signaling that while Florida remains a key market, some cities are feeling the pinch more than others.

Emerging Development Hotspots

In contrast to the decline in some major metros, smaller markets are emerging as new development hotspots. Cities like Chicago, Anaheim, and Fayetteville are seeing significant growth in permitting, with an increase of 1,200 to 2,200 units. Even mid-sized cities like Omaha, Des Moines, and Augusta have jumped onto the radar, signaling where developers are pivoting as they look for opportunities beyond traditional markets.

Key Takeaways: Where Do We Go From Here?

Multifamily permitting levels serve as a crucial barometer for future real estate supply and sentiment. While some of the pandemic-era hotbeds are cooling off, we’re seeing fresh momentum in new markets that offer more affordable land, labor, and development opportunities. For real estate developers and investors, the story is clear: emerging markets are now poised to take the lead.

As traditional metros cool down, it’s the smaller cities and less saturated markets that are showing promise. Developers who are quick to adjust their strategies and seek opportunities in these new hotspots will likely be ahead of the curve.

For those of you looking to stay ahead of the competition, tracking multifamily permit data is a crucial piece of the puzzle. The cities seeing growth today could be tomorrow’s most profitable locations.

If you’re interested in learning more about where these shifts are happening and how you can capitalize on them, check out our full analysis and stay ahead of the curve as these trends unfold.

By connecting the dots between permitting trends and emerging development opportunities, this blog post provides valuable insights to investors looking to stay agile in an ever-changing market.

Comments

Post a Comment