Multifamily’s Second Wind: The Next Set of Glory Days

We’ve all lived through it—2021 through 2023 were, in many ways, the glory days of multifamily development. Capital was flowing, interest rates were low, the remote work wave was at full strength, and cap rates compressed fast enough to justify just about anything. Banks were bullish. Tariffs were a distant memory. Even skyrocketing construction costs couldn’t stop deals from penciling because demand was simply that strong.

For a while, it felt like every site was a winner—especially in the “cool” markets. Say no to a deal in Austin, Nashville, or Charleston, and you risked being labeled out of touch. The pipeline was overflowing. But as is often the case in real estate, when too many players rush into the same game, overbuilding isn’t far behind.

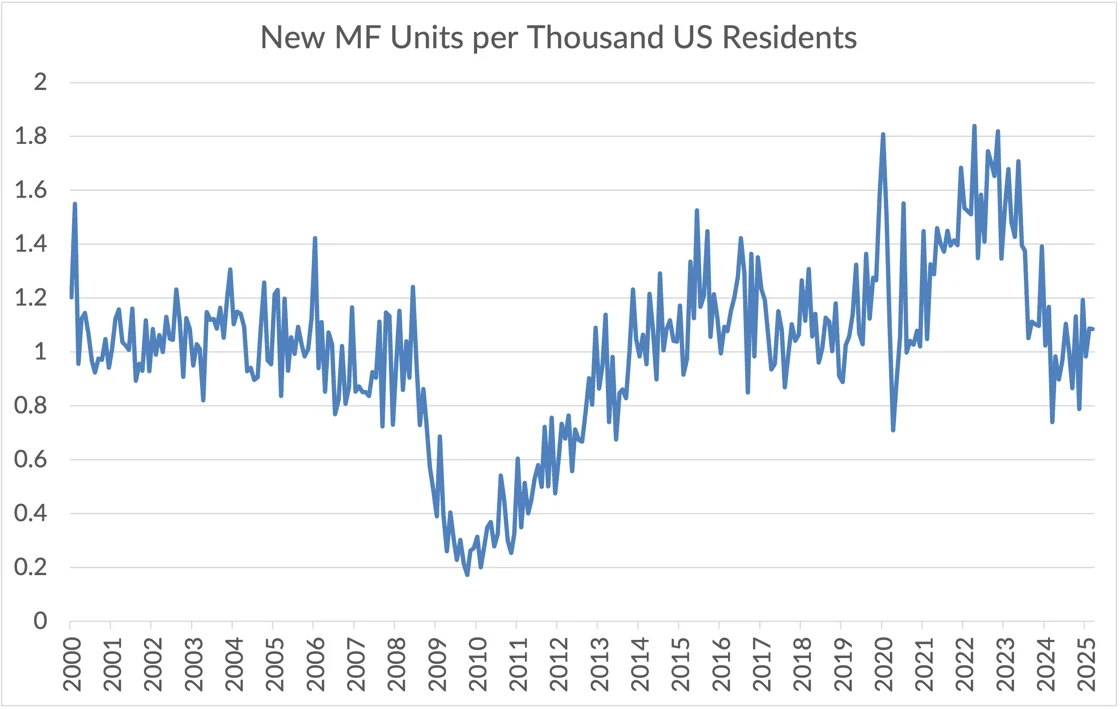

Just take a look at new multifamily construction levels compared to U.S. population growth. Two things are immediately clear:

- We’re still building at rates comparable to the late 1990s and early 2000s—activity remains elevated.

- During the Global Financial Crisis, new construction plummeted. That lack of new supply set the stage for one of the most aggressive rent growth cycles we’ve ever seen, which came to a head in 2023 when rates shifted and the math stopped working.

Trying to forecast this industry by looking at historical data alone is like driving forward with your eyes glued to the rearview mirror. It’s possible, but you’ll probably hit something.

And right now, the obstacles are real. The AIA’s latest architecture billing index shows 27 out of the last 30 months in decline. Getting a deal to underwrite in this environment takes a risky blend of optimism: rates will fall, rents will rise, exit values will hold.

But tariffs are back in the headlines, and that optimism is quickly evaporating. Any pricing relief developers squeezed from contractors over the last 18 months risks being wiped out by higher material and labor costs.

So what’s ahead?

Expect a slowdown. Not a crash—but a clear deceleration in planning, design, and construction activity in 2025. The multifamily starts pipeline will thin out, and with single-family affordability still constrained, there won’t be much new competition on the horizon.

And that sets the stage for what comes next.

We know how this works: fewer starts today mean tighter supply tomorrow. Multifamily is slow to build—but that’s exactly why existing owners are about to enter a new cycle of pricing power and rent growth.

It won’t happen overnight. But for those who’ve made it through this phase, the next set of glory days may be just around the corner.

Comments

Post a Comment