The Florida Cooldown: What Developers and Investors Need to Know

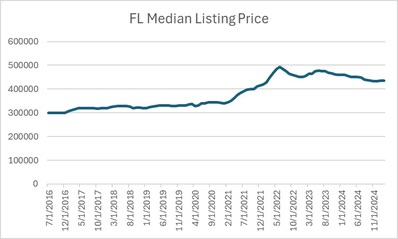

For years, Florida has been the poster child for post-pandemic real estate booms. But today, that narrative is shifting. According to new data from Cotality (formerly CoreLogic), three Florida markets—Tampa, Winter Haven, and West Palm Beach—are at “very high risk” of home price declines in 2025.

That doesn’t mean the Florida story is over—but it’s evolving. For developers and investors, this is a critical inflection point.

What the Data Is Saying

Cotality’s analytics show these metros have a 70% or greater likelihood of home price drops in the coming year, with key indicators flashing yellow:

• Tampa: Median list price of $463,000, down 0.9% YoY and 1.6% since Q4 2024

• Winter Haven: Median list price of $305,000, down 0.9% YoY

• West Palm Beach: Median list price of $369,500, down 0.5% YoY

While these aren’t dramatic crashes, they reflect a cooling trend that savvy investors can’t afford to ignore.

“What we’re seeing is a rebalancing after an overheated cycle,” says Daniel Kaufman, President of Kaufman Development.

“Markets that saw explosive growth in 2020–2022 are now wrestling with affordability, oversupply, and insurance shocks. Developers who were riding the wave now need to get tactical.”

What’s Driving the Shift?

Several key factors are converging:

• Skyrocketing insurance costs: Homeowners insurance in Florida has become a major pain point, especially in coastal areas.

• Overdevelopment: Supply is catching up fast in some markets, and buyers now have options—especially in the luxury sector.

• Affordability ceiling: Rapid price increases during the pandemic have outpaced wage growth, shrinking the buyer pool.

• Climate risk awareness: While not always top of mind, rising concerns over hurricanes, sea-level rise, and future insurability are starting to influence long-term investment strategies.

West Palm Beach in particular illustrates the paradox: massive development is underway, with billions being poured into luxury condos, high-end rentals, and mixed-use mega projects. Yet prices are dipping—highlighting the volatility of high-end markets and the challenge of competing with incentive-rich new construction.

Is This a Blip or a Reset?

This isn’t a crash—but it is a course correction. The “real estate party” of 2020–2022 created froth, and markets like Florida are now settling into a new normal.

“The data tells a cautionary tale,” Kaufman adds.

“For sellers, timing and pricing strategy have never been more critical. For developers and institutional investors, it’s a moment to step back and reassess: Are we building for today’s demand—or yesterday’s?”

Strategic Takeaways for Developers & Investors

1. Get granular: Not all Florida markets are equal. Submarket analysis and local fundamentals matter more than ever.

2. Reevaluate luxury exposure: The high-end market is showing the most price softness—and the most buyer hesitation.

3. Watch insurance trends closely: Rising premiums are influencing both buyer psychology and underwriting assumptions.

4. Explore alternative markets: Migration data is showing increased interest in Tennessee, Georgia, and North Carolina—markets with fewer climate risks and more cost stability.

Final Thought

The Florida housing market isn’t collapsing—it’s correcting. And for those who understand the signals, there’s still opportunity in the chaos. But it requires a shift in strategy, focus, and expectations.

At Kaufman Development, we’re helping our partners navigate this transition with eyes wide open—and with the data to back it up.

Visit www.danielkaufmanre.com for more insights, market commentary, and investor guidance.

Comments

Post a Comment