The Apartment Market Isn’t Cooling—It’s Heating Up

By Daniel Kaufman

Lately, a lot of folks have asked me the same question: Are we seeing signs that apartment demand is slowing down? My short answer: No. In fact, demand is stronger than ever.

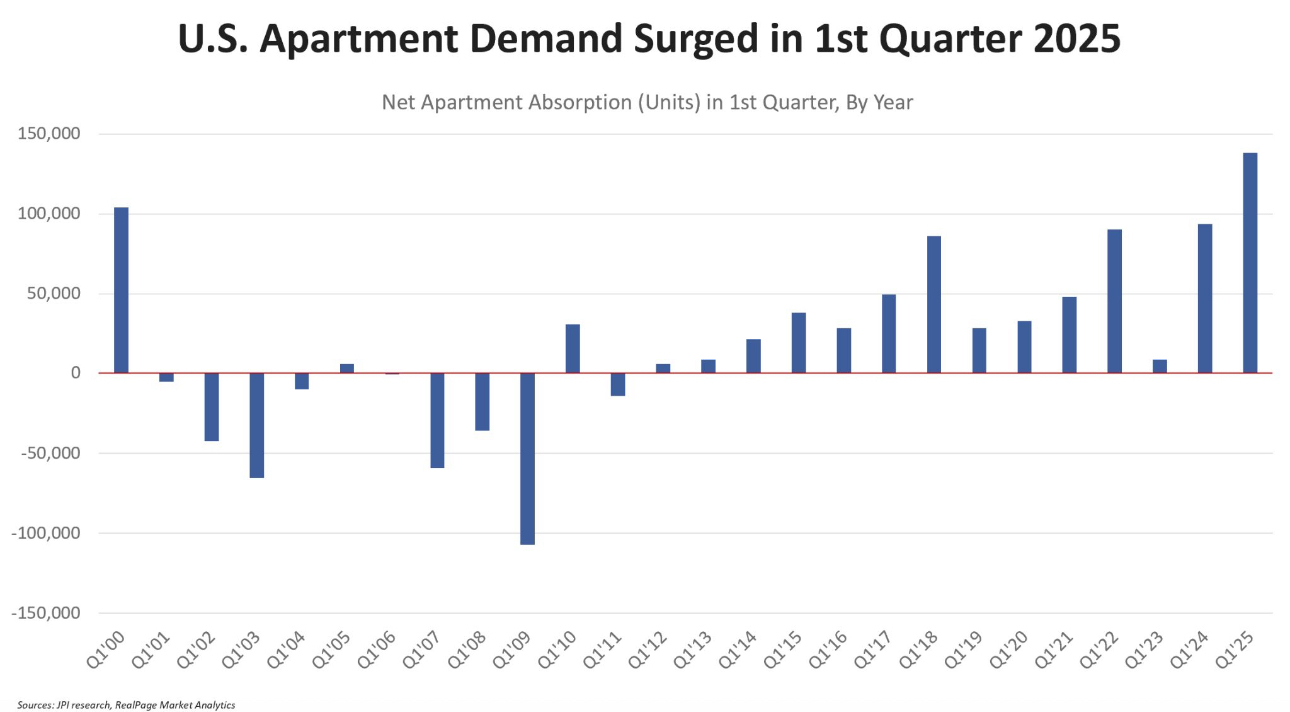

The numbers don’t lie. According to RealPage, Q1 2025 posted the highest first-quarter net absorption in over 25 years, with more than 138,000 units absorbed. CoStar puts the figure slightly lower at 128,000, calling it the second-best Q1 in the same time frame. Whether it’s #1 or #2 doesn’t really matter—what matters is that absorption this strong in Q1 is almost unheard of.

For context, we typically expect this kind of leasing velocity in Q2 or Q3, when the market hits its seasonal stride. But this year, the demand hit early—and it hit hard.

Where’s the demand coming from?

All over. Texas remains red-hot, as expected, but strong leasing activity extended across the Sun Belt and into key metros on the East Coast, West Coast, and Midwest. The trailing-12-month absorption is now nearing 2021 levels—though it’s worth noting that we have far more inventory today than we did in 2021.

Now, I know the popular narrative: “Well, of course apartment demand is strong—no one can buy a house right now.” Sure, elevated mortgage rates and affordability pressures are keeping many would-be buyers on the sidelines. But that’s not the full story—and it’s not even the most interesting part.

Here’s why that logic falls short:

- Apartments are outperforming single-family rentals. If this were purely about people not buying homes, we’d expect SFR demand to be just as strong. But it’s not. Apartments are seeing much higher net absorption.

- Move-outs to home purchase are down, which helps retention—but that alone doesn’t explain the sheer volume of net new renters entering the market.

So what’s driving all this demand? A few key dynamics are at play:

1. New supply is unlocking pent-up demand.

We’re at the tail end of a generational high in apartment deliveries. And when new product hits the market, it doesn’t just shuffle existing renters around—it creates a ripple effect. Renters move up into newer units, which opens space in Class B and C properties, making room for new entrants into the rental pool. That’s demand generation in motion.

2. More young adults are moving out.

The percentage of young adults living at home is declining again. For many of them, their first step into independence is a lease—not a mortgage. And with vacancy still elevated due to high supply, there’s opportunity for these renters to find housing at more accessible price points.

3. The job and wage story is better than it looks.

Despite recession talk and a messy macro backdrop, wages have now outpaced rent growth for 27 straight months. That’s huge. It expands the renter pool, increases affordability, and supports continued absorption—even in the face of economic uncertainty.

That’s all through Q1. What happens next depends on a few variables—chief among them: the emerging tariff fight, which is already throwing some curveballs into the cost and confidence landscape.

But here’s what I’ll be watching closely:

If apartment demand holds steady through peak leasing season—even moderately—while new supply slows down, we could be looking at a perfect setup for a rent rebound by year-end. And that aligns squarely with the investment thesis we’re focused on across our portfolio.

More to come.

If you’re a developer, operator, or investor thinking about timing, pricing power, or absorption curves—this is the moment to pay attention.

Let’s see how Q2 plays out. Thoughts?

Comments

Post a Comment