NYC Rental Market Soars: What It Means for Real Estate Investors & Developers

Manhattan rents are at an all-time high, with bidding wars pushing prices even further. For real estate investors and developers, this signals both risk and opportunity. The intense demand and limited supply are reshaping the rental landscape, making NYC an increasingly lucrative market for those who know how to navigate it.

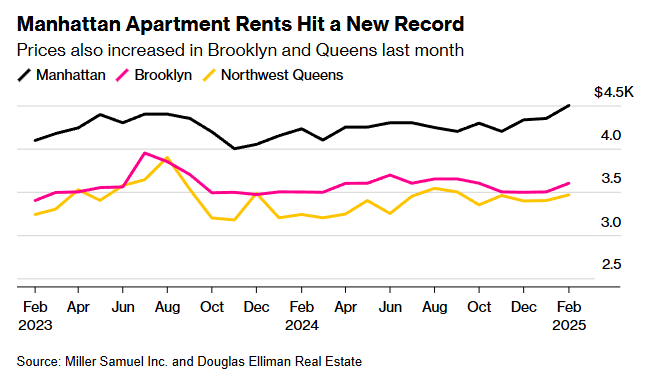

The Numbers: NYC Rents Reach Record Highs

According to data from Miller Samuel and Douglas Elliman, Manhattan apartment rents hit a new record in February 2025, reaching a median of $4,500—a 6.4% year-over-year increase.

Key Market Trends

• Bidding Wars Are Up – Nearly 27% of new Manhattan leases were signed above asking price, marking the highest share ever recorded.

• Brooklyn & Queens Are Heating Up – Brooklyn’s median rent climbed to $3,600, while affluent areas of Queens like Astoria and Long Island City saw rents jump 7% year-over-year.

• Competition in Brooklyn Is Fierce – 35% of new leases in Brooklyn involved bidding wars, showing that Manhattan’s rental squeeze is spilling into other boroughs.

This rapid price growth—even during winter, when rents typically slow down—suggests that the rental market remains resilient despite economic uncertainty.

Why This Matters for Investors & Developers

The NYC rental market is moving fast, and the conditions fueling record-high rents create key opportunities for those in real estate development and investment.

1. High Demand Means Stronger ROI for Landlords

With buying affordability at historic lows, renters are staying put. More tenants competing for fewer available units leads to higher rent growth and lower vacancy rates, making this an ideal time for landlords to expand rental portfolios or renovate existing properties to command premium rents.

2. Development Potential in High-Demand Boroughs

Manhattan rents are skyrocketing, pushing demand outward into Brooklyn and Queens. Investors should be looking at multifamily development and value-add opportunities in Astoria, Long Island City, and parts of South Brooklyn—areas where competition is fierce but price points are still attractive compared to Manhattan.

3. The Bidding War Effect: A Signal for Supply Expansion

With 27% of Manhattan leases and 35% of Brooklyn leases seeing bidding wars, it’s clear that supply is not keeping up with demand. New rental developments could capture this demand—especially in neighborhoods where inventory remains tight. Developers who can bring projects online quickly stand to benefit from strong absorption rates.

4. Luxury & Premium Rental Market Is Thriving

With homebuyers sitting on the sidelines due to high mortgage rates, luxury rental demand is surging. Investors and developers catering to high-income renters—especially with high-end amenities, concierge services, and smart home features—will find a highly receptive market in 2025.

Challenges to Consider

While NYC’s rental market is lucrative, investors and developers should also be aware of potential headwinds:

1. Rent Stabilization & Regulatory Risks

New York’s strict rent laws could impact ROI for landlords, particularly for older buildings with rent-stabilized units. Understanding the latest rent control policies is critical before making investment decisions.

2. Rising Construction & Financing Costs

Developers must factor in rising labor and material costs, along with higher interest rates on construction loans. Careful underwriting and leveraging opportunity zones, tax incentives, or public-private partnerships can help offset these costs.

3. Economic Volatility & Market Uncertainty

While rental demand is high now, macroeconomic factors—such as interest rate fluctuations, inflation, and potential government policy shifts—could affect investor sentiment and pricing strategies in the next 12–24 months.

What’s Next for NYC’s Rental Market?

Despite challenges, NYC’s rental market remains one of the most resilient in the country. Developers and investors who adapt to these trends—by expanding into high-growth boroughs, capitalizing on luxury rental demand, and staying ahead of regulatory changes—stand to benefit significantly.

With bidding wars driving rents higher and supply remaining tight, now is the time to make strategic investments in New York real estate.

Are you ready to capitalize on NYC’s rental boom?

Comments

Post a Comment