Market Signals & Streaming Realities

While we’re counting down the hours to tonight’s Severance season finale on Apple TV+, the macro data is painting a less thrilling picture. Apple’s streaming service is reportedly burning over $1 billion per year, making it the only segment in its Services division that’s running in the red. That’s notable — Apple’s Services unit has been a fortress of profitability, and a drag here raises questions about capital efficiency, content strategy, and whether even Big Tech can buy its way into long-term streaming dominance.

Meanwhile, equity markets were mixed on Thursday:

• S&P 500: -0.2%

• Nasdaq 100: -0.3%

• Russell 2000: -0.6%

Sector-wise, Utilities, Energy, Financials, and Healthcare posted gains, while Tech, Materials, and Industrials were the primary laggards.

Nvidia staged a modest rally — but investors took note of the stock’s first “dark cross” since 2022, a potential technical warning sign.

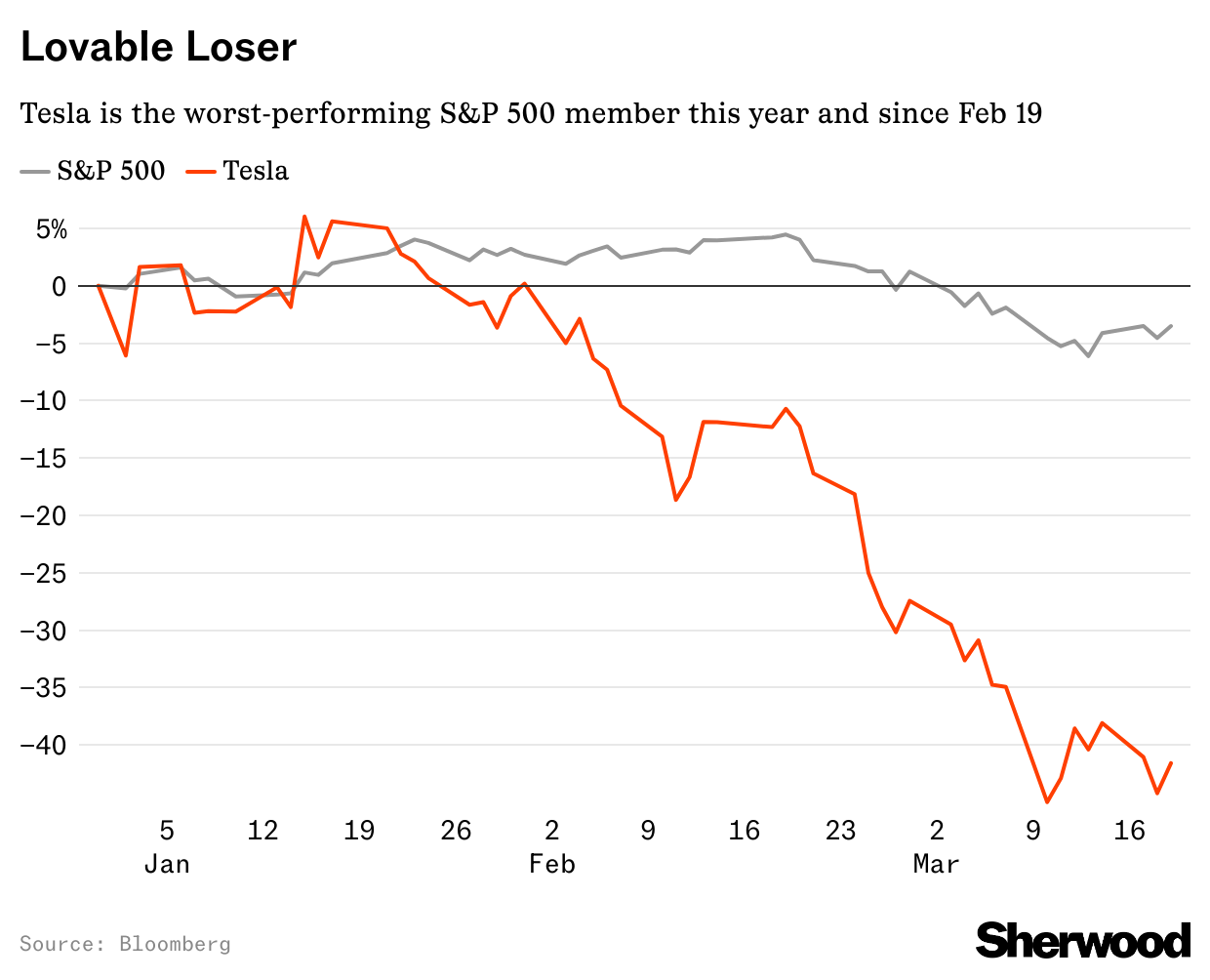

Tesla’s Troubles: Is a Turnaround in Sight?

Tesla has had a rough stretch. The stock is down 17.1% over the past 12 trading days, triggered by a combination of insider selling, slashed delivery estimates, soft early-year sales, and competitive headwinds in autonomous driving and EV charging.

Public perception is also slipping. The brand is no longer bulletproof — and that’s a problem.

Then came the recall of over 46,000 Cybertrucks. Add to that aggressive poaching by rivals like Lucid and Polestar, both offering thousands in incentives to lure Tesla owners, and it’s clear: Tesla needs a win.

There might be one on the horizon.

Yesterday, Tesla revealed plans to incorporate dry cathode battery tech in the Cybertruck — a production innovation that could significantly reduce costs. Unlike traditional batteries requiring toxic solvents and energy-intensive drying ovens, dry cathodes promise up to $1 billion in annual savings for Tesla, if scaled successfully.

The Takeaway:

If Tesla can lead on dry cathode production, it may reclaim its edge. But execution risk is high, and the broader EV narrative is shifting. Investors should watch this one closely.

Big Tech, Big Deals: Google & Apple’s $20B Search Pact

In 2022, Google paid Apple $20 billion to remain the default search engine on iPhones — a quietly massive number that helps power Google’s $250B+ annual ad business. As antitrust scrutiny intensifies, this deal is drawing more heat — and investors in both companies should stay tuned. The stakes are enormous.

Meanwhile, Mode Mobile is positioning itself as a disruptor to the ad-data model, turning smartphones into income-generating assets for users. Backed by fast growth metrics (32,481% over three years) and a potential Nasdaq IPO (ticker: $MODE), Mode is challenging the old guard by splitting ad revenue with its user base.

AI Arms Race: OpenAI’s o1-pro & the Cost of Intelligence

OpenAI’s newly released o1-pro model is one of the most powerful — and expensive — AI tools to date. Geared toward enterprise customers, it’s built for complex reasoning and large-scale operations. But the economics are daunting.

• Input and output are priced by “tokens,” with high-output requests costing exponentially more.

• For comparison: DeepSeek charges $2.19 per million-token output. OpenAI’s model is significantly higher.

• OpenAI reportedly lost $5 billion in 2024, bringing in just $3.7 billion in revenue.

The Takeaway:

The generative AI business model remains unproven. With sky-high compute costs and unclear monetization paths, even OpenAI is searching for sustainable economics. Investors should prioritize companies with efficient AI infrastructure and enterprise-level pricing power.

Other Notables:

• Accenture posted strong earnings but slid on guidance concerns.

• Gartner dipped after being mentioned in a defense-related X post.

• Darden Restaurants rallied — apparently, consumers aren’t ready to give up their Olive Garden breadsticks.

• Cava surged after JPMorgan gave it a long-term buy rating. The Mediterranean fast-casual segment is heating up.

Comments

Post a Comment