Office-to-Residential Conversions Surge But Will They Deliver?

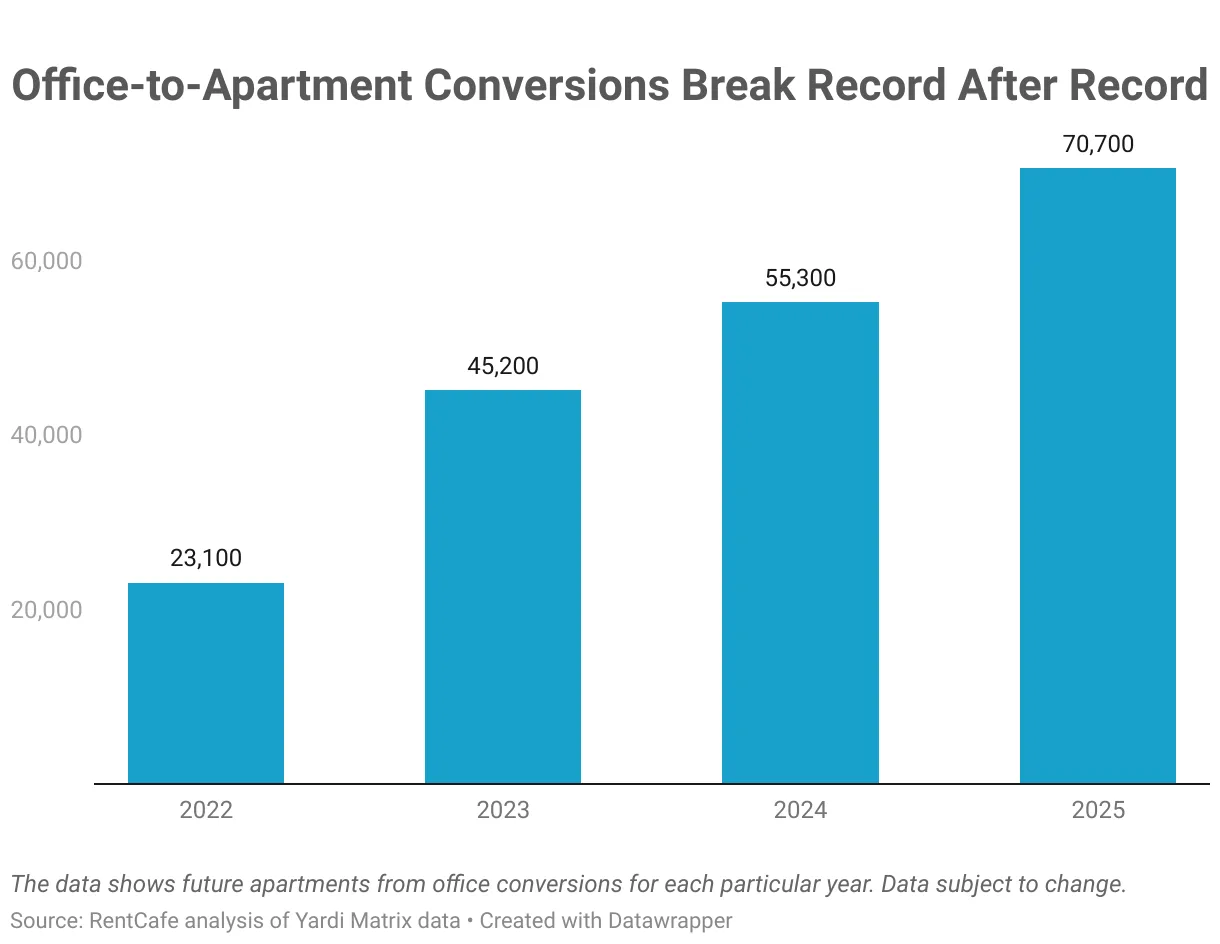

The office-to-residential conversion boom is officially here. With record-high office vacancies, housing shortages, and new incentives, conversions now account for 42% of all adaptive reuse projects, nearly tripling in just three years.

But while the pipeline has surged to 71,000 units, the reality is that many of these projects face significant barriers to completion from high construction costs to zoning roadblocks and slow approvals. For real estate developers and investors, the key question isn’t just where the opportunities exist, but which projects will actually get built and how to position yourself for success in this growing sector.

Where the Biggest Office-to-Resi Opportunities Are

New York City (8,310 units planned)

State and local tax incentives are fueling a wave of conversions, with major players like SL Green and GFP Real Estate leading acquisitions.

Washington, D.C. (6,533 units)

The city’s 20-year tax abatement under the Housing in Downtown initiative is driving developer interest, making D.C. a top market for conversion deals.

Los Angeles (4,388 units)

L.A. has seen an 80% year-over-year increase in conversions, thanks to a shift in local policies aimed at reducing regulatory barriers.

Other Emerging Markets: San Francisco, Minneapolis, and More

Cities across the U.S. are rolling out streamlined permitting processes, dedicated financing districts, and tax incentives to encourage conversions and repurpose outdated office inventory.

Newer Office Buildings Are Now in Play

Historically, conversions focused on older buildings with distinct architectural features. But that’s changing:

Modern offices (built 1990-2010) now account for 7% of planned conversions, a sharp increase from just 1.3% of past completed projects.

Why? Newer buildings require fewer structural upgrades, making conversions more financially viable despite high construction costs. Investors looking for the best conversion opportunities should target properties that already align with residential layouts and require minimal retrofitting.

The Biggest Challenges to Office-to-Resi Success

Despite record-breaking demand, many office-to-resi projects never make it past the planning phase.

Zoning & Regulatory Hurdles

Many cities still lack clear frameworks for conversions, leading to drawn-out approvals.

High Construction & Financing Costs

With elevated interest rates, tight capital markets, and expensive retrofits, projects must be strategically structured to remain profitable.

The Execution Gap

While 1.2B SF of office space is considered suitable for conversion, only a fraction of these projects will become reality unless cities actively cut red tape and increase financial incentives.

What This Means for Developers & Investors

Focus on Cities Actively Pushing Conversions

Markets like NYC, D.C., and L.A. are leading the way with tax incentives, fast-tracked approvals, and financial support. Regulatory-friendly environments will determine project viability.

Target Properties with Lower Retrofit Costs

Newer office buildings are gaining traction in the conversion market, making 1990s-2010s properties a compelling play for developers looking to avoid costly structural modifications.

Look for Public-Private Partnership Opportunities

Many cities are recognizing the need for more housing and are actively offering tax breaks, financing incentives, and zoning flexibility to push conversions forward. Developers who align with these initiatives will have the upper hand.

Final Takeaway: The Opportunity Is Real

If Cities and Developers Can Deliver

Office-to-residential conversions represent one of the most promising real estate trends in today’s market but the gap between projects in the pipeline and actual completions remains wide.

With the right regulatory support and investor strategies, conversions could reshape the future of urban real estate but only if developers can navigate financing, zoning, and construction challenges effectively.

Is your firm exploring office-to-resi opportunities? Let’s discus drop your thoughts in the comments!

Comments

Post a Comment