How New Steel and Aluminum Tariffs Could Impact Real Estate Development and Investment

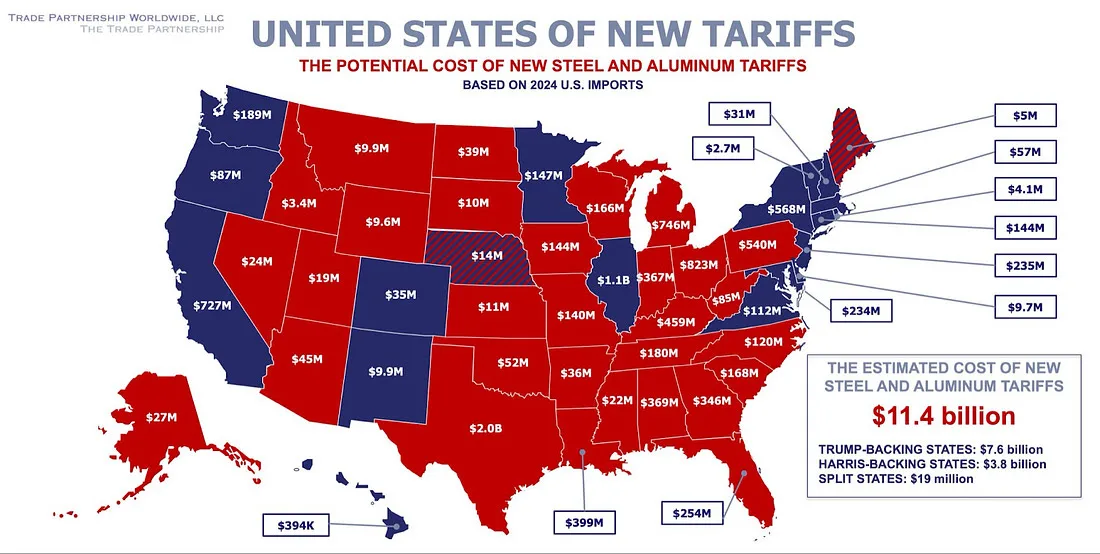

The U.S. real estate market is facing a new challenge, rising construction costs due to steel and aluminum tariffs. Based on 2024 import data, the estimated cost of these new tariffs amounts to $11.4 billion, with $7.6 billion hitting Trump-backing states and $3.8 billion affecting Harris-backing states. Whether you’re a developer planning a multifamily project or an investor analyzing market trends, these tariffs could significantly impact your bottom line.

What This Means for Developers

Steel and aluminum are essential materials in real estate construction, from structural framing to HVAC systems. The increased cost of these materials will likely lead to:

Higher Development Costs

Rising steel and aluminum prices will push up construction costs, making new builds more expensive and reducing margins.

Potential Project Delays

Contractors and suppliers may struggle with fluctuating costs, causing delays in procurement and completion timelines.

Increased Rents and Property Prices

To offset rising costs, developers may need to increase rents and property prices, impacting affordability for tenants and buyers.

Investor Takeaways

For real estate investors, these tariffs introduce new factors to consider when evaluating markets:

Construction-Heavy Markets at Risk

States with high new construction activity (such as Texas and Florida, which face $2.0 billion and $1.2 billion in tariff costs, respectively) may experience slowed development and rising asset prices.

Shift Toward Adaptive Reuse and Renovations

Investors may find opportunities in existing properties that require less new material, making value-add strategies more appealing.

Long-Term Inflationary Pressure

Increased material costs may drive broader inflation in the real estate sector, affecting CAP rates and long-term investment strategies.

How to Navigate the Changes

Secure Material Pricing Early

Developers should work with suppliers to lock in pricing where possible to mitigate future cost spikes.

Explore Alternative Building Materials

Looking into timber, prefabrication, or other construction innovations could help offset costs.

Monitor Policy Changes

As tariffs evolve, staying informed on potential trade negotiations or domestic production incentives will be critical.

Final Thoughts

The real estate industry must adapt to these new cost pressures. Whether you’re developing large-scale multifamily projects or investing in commercial assets, understanding the implications of these tariffs is key to making informed decisions. Being proactive with cost management and strategic planning will be essential for maintaining profitability in the years ahead.

Have thoughts on how these tariffs might affect your projects? Share in the comments below!

Comments

Post a Comment