Historic Multifamily Absorption: What Developers and Investors Need to Know

The CBRE Q4 2024 National Multifamily Report is out, and the absorption data is nothing short of historic. Multifamily demand is not only surging but it Is outpacing supply in ways we have never seen before. For developers and investors, this presents both opportunities and challenges in navigating a rapidly evolving landscape.

Here are six key takeaways from the report that highlight just how unprecedented this market shift is:

1. Q4 2024 Had Record-Breaking Absorption

Absorption in Q4 2024 was the highest of any fourth quarter on record 12 times higher than the pre-pandemic Q4 average. This signals a strong resurgence in renter demand, defying seasonal trends that typically show a slowdown in the last quarter of the year.

2. Demand Outpaced Supply by 18%

Over the full year, multifamily demand exceeded the 451,000 units added to the market by 18%. This level of demand was more than double the absorption seen in 2023, demonstrating the sustained appetite for rental housing.

3. Every Single CBRE-Tracked Market Saw Positive Absorption

For the first time ever, all 69 markets tracked by CBRE recorded positive net absorption in Q4 2024. Even more impressively, every single market also saw positive net absorption on an annual basis. This uniform growth across markets underscores a nationwide shift in rental demand.

4. Supply Growth and Future Pipelines are Balancing

Of the top 15 markets for net absorption:

12 grew their total supply by more than 3% over the past year.

10 have construction pipelines under 5% of their existing inventory.

This suggests that while developers are still delivering new units, the balance between new supply and demand is becoming more sustainable, preventing oversaturation.

5. Demand is Outpacing New Supply in Most Key Markets

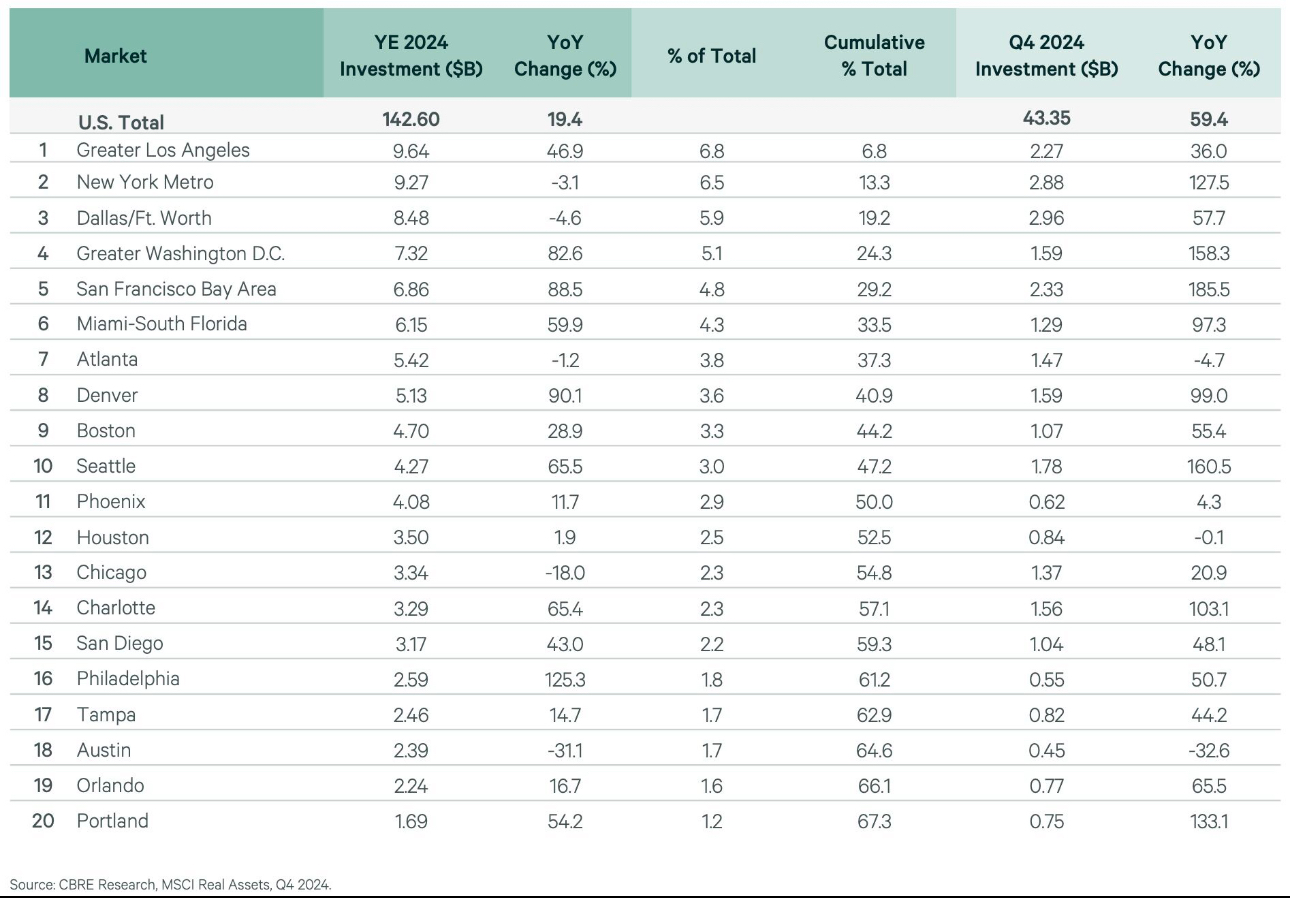

In 2024, 16 of the top 20 markets for new supply saw absorption exceed new completions. The only exceptions? Austin, Orlando, Tampa, and Minneapolis markets that have been historically supply-heavy and are still working through excess inventory.

6. Q4 Absorption Outpaced Completions in 19 of the Top 20 Markets

This trend is not slowing. 19 of the top 20 markets (with the lone exception of Minneapolis) saw more net absorption than new deliveries in Q4 2024. This is a major shift from recent years, where new supply had often outpaced demand in many metros.

What This Means for Developers and Investors

With demand accelerating across nearly all markets, this data presents a compelling case for continued investment in multifamily housing. However, supply imbalances still exist in certain metros, making market selection and product positioning more critical than ever.

As Daniel Kaufman, founder of Kaufman Development, notes:

”The numbers confirm what we have been seeing multifamily demand is stronger than ever. But sustainable development requires a sharp focus on market fundamentals. Investing in areas where absorption is outpacing supply will be key to long-term success.”

Final Thoughts

This 11-page CBRE report is essential reading for anyone in the multifamily industry. The historic levels of absorption signal a major shift in rental demand, and developers and investors who stay ahead of these trends will be best positioned for success in 2025 and beyond.

For more insights, check out the full CBRE report and stay informed on how these trends will shape the market.

Comments

Post a Comment